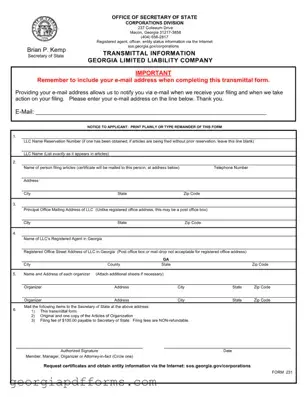

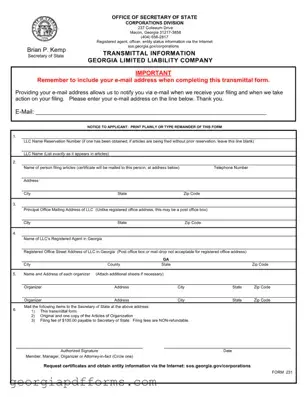

The Georgia 231 form is a transmittal document used for filing Articles of Organization for a Limited Liability Company (LLC) in the state of Georgia. This form facilitates the registration process by collecting essential information about the LLC, including its...

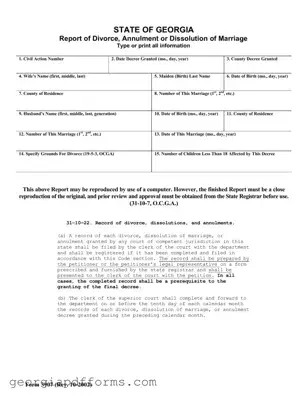

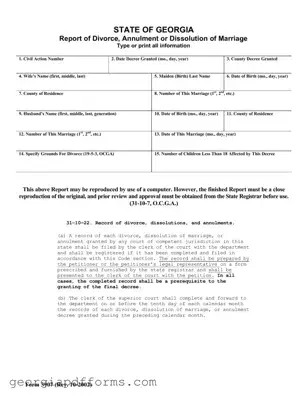

The Georgia 3907 form is a legal document used to report the dissolution of a marriage, including divorces and annulments, within the state of Georgia. This form captures essential information such as the names of the parties involved, the date...

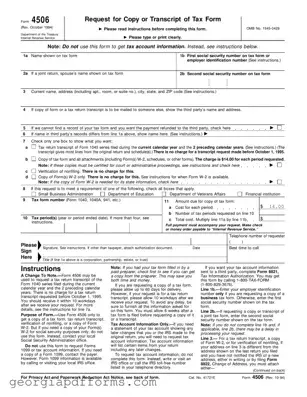

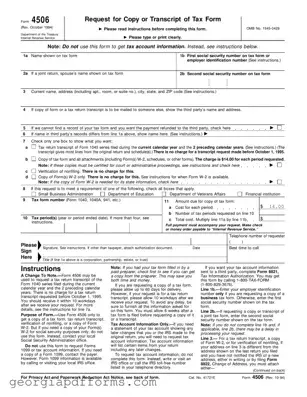

The Georgia 4506 form is a request form used to obtain copies or transcripts of tax returns from the Internal Revenue Service (IRS). This form allows individuals to access important tax documents, including tax return transcripts and verification of nonfiling....

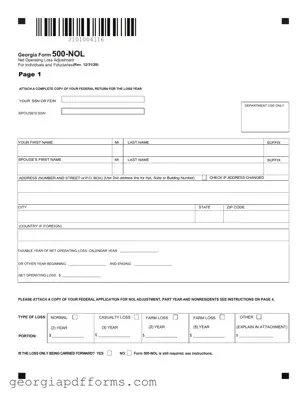

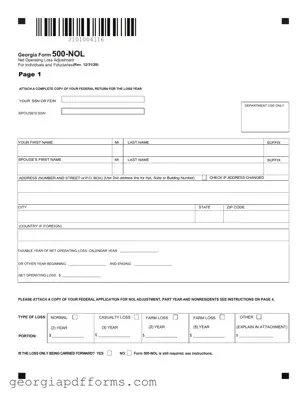

The Georgia Form 500-NOL is a tax form used to report a net operating loss adjustment for individuals and fiduciaries. This form allows taxpayers to claim a refund for taxes by carrying back a net operating loss incurred in a...

The Georgia Form 500 is the Individual Income Tax Return required for residents and non-residents filing their state taxes. This form collects essential information about your income, deductions, and credits to determine your tax liability. Completing this form accurately is...

The Georgia Form 501X is an Amended Fiduciary Income Tax Return used by fiduciaries to report changes to previously filed returns. This form is essential for ensuring that any adjustments, whether due to IRS changes or other reasons, are accurately...

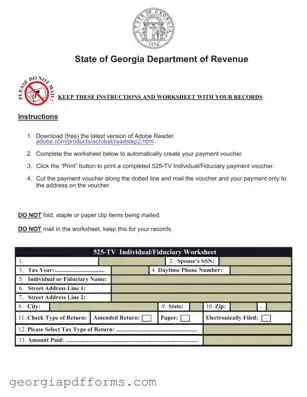

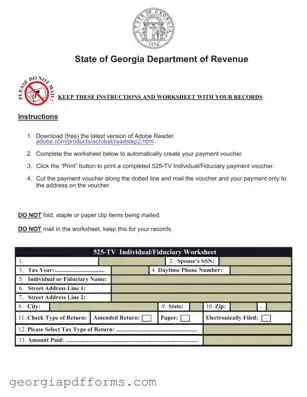

The Georgia 525-TV form is a payment voucher used by individuals and fiduciaries to remit taxes owed to the state. This form simplifies the payment process, allowing taxpayers to submit their payments accurately and efficiently. Proper completion and submission of...

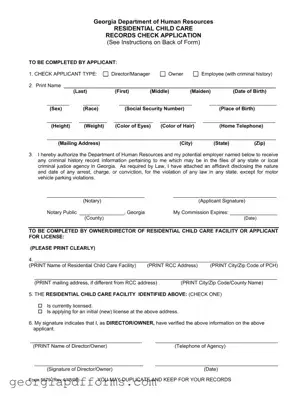

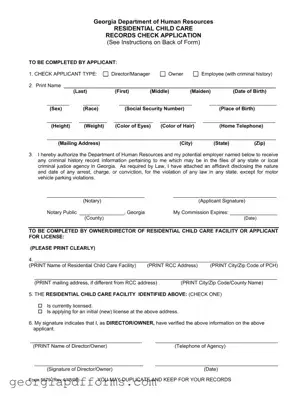

The Georgia 5579 form serves as the Residential Child Care Records Check Application, a crucial document for individuals seeking employment or licensure within residential child care facilities in Georgia. This form collects essential personal information and authorizes the Department of...

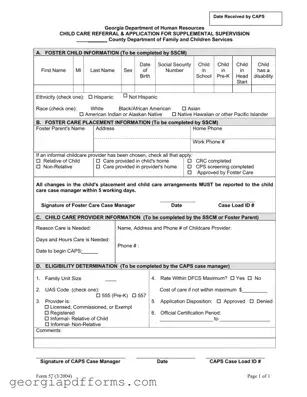

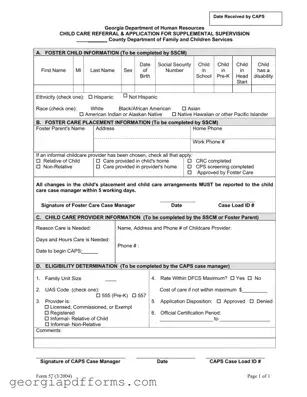

The Georgia 57 form is a crucial document used for child care referral and application for supplemental supervision. It helps ensure that foster children receive the appropriate care and support they need while living in foster homes. This form collects...

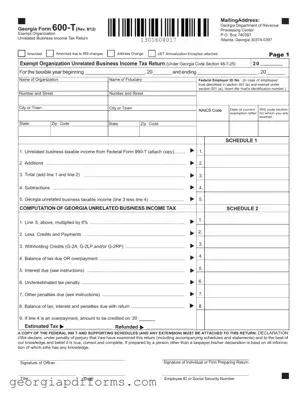

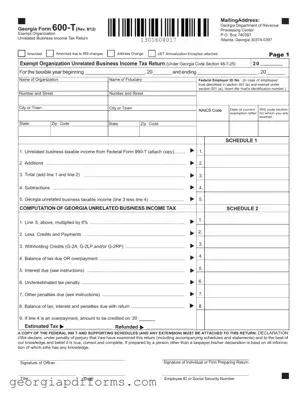

The Georgia Form 600-T is the Exempt Organization Unrelated Business Income Tax Return, which must be filed by exempt organizations that generate unrelated business income from Georgia sources. This form is necessary for compliance with Georgia tax regulations and is...

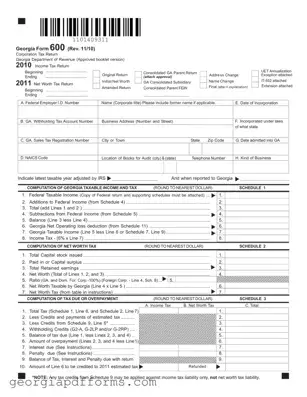

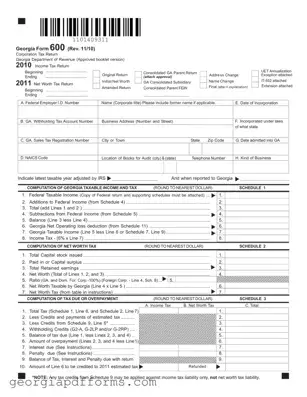

The Georgia Form 600 is a tax return used by corporations to report their income and calculate taxes owed to the state of Georgia. This form includes sections for federal taxable income, net worth tax, and various credits and deductions....

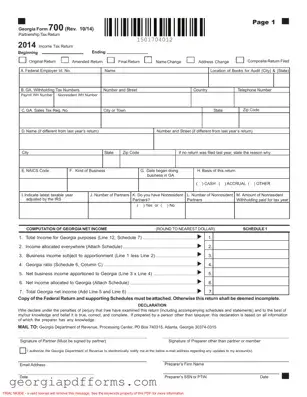

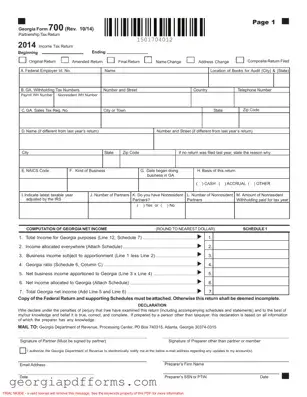

The Georgia Form 700 is a tax return specifically designed for partnerships operating in Georgia. This form is essential for reporting income, deductions, and credits related to partnership activities within the state. Completing the Georgia Form 700 accurately ensures compliance...