What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Georgia to transfer their real estate to designated beneficiaries upon their death. This deed enables the property to pass outside of probate, simplifying the transfer process for heirs.

Who can create a Transfer-on-Death Deed?

Any individual who owns real property in Georgia can create a Transfer-on-Death Deed. The property owner must be of legal age and mentally competent to execute the deed. Joint owners can also designate beneficiaries for their share of the property.

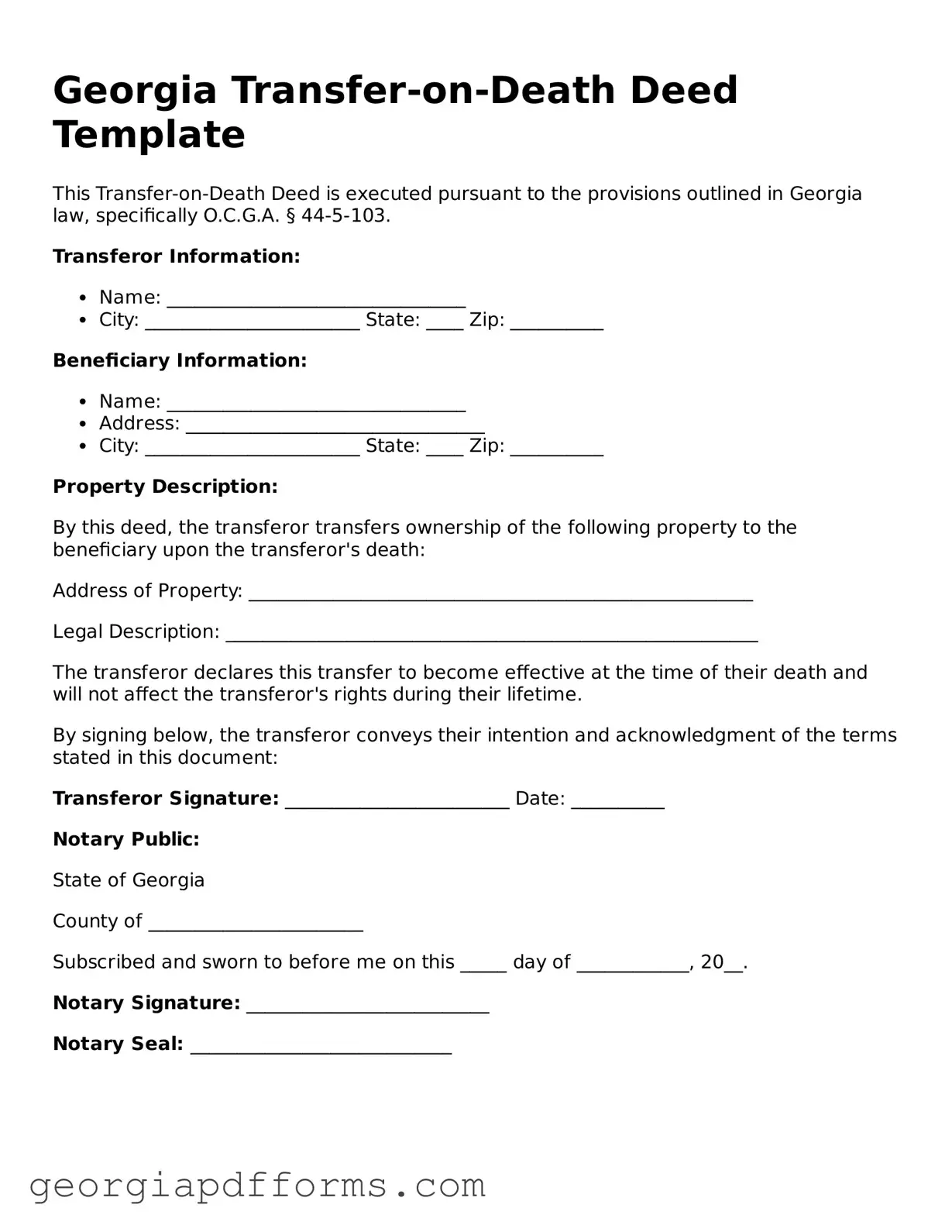

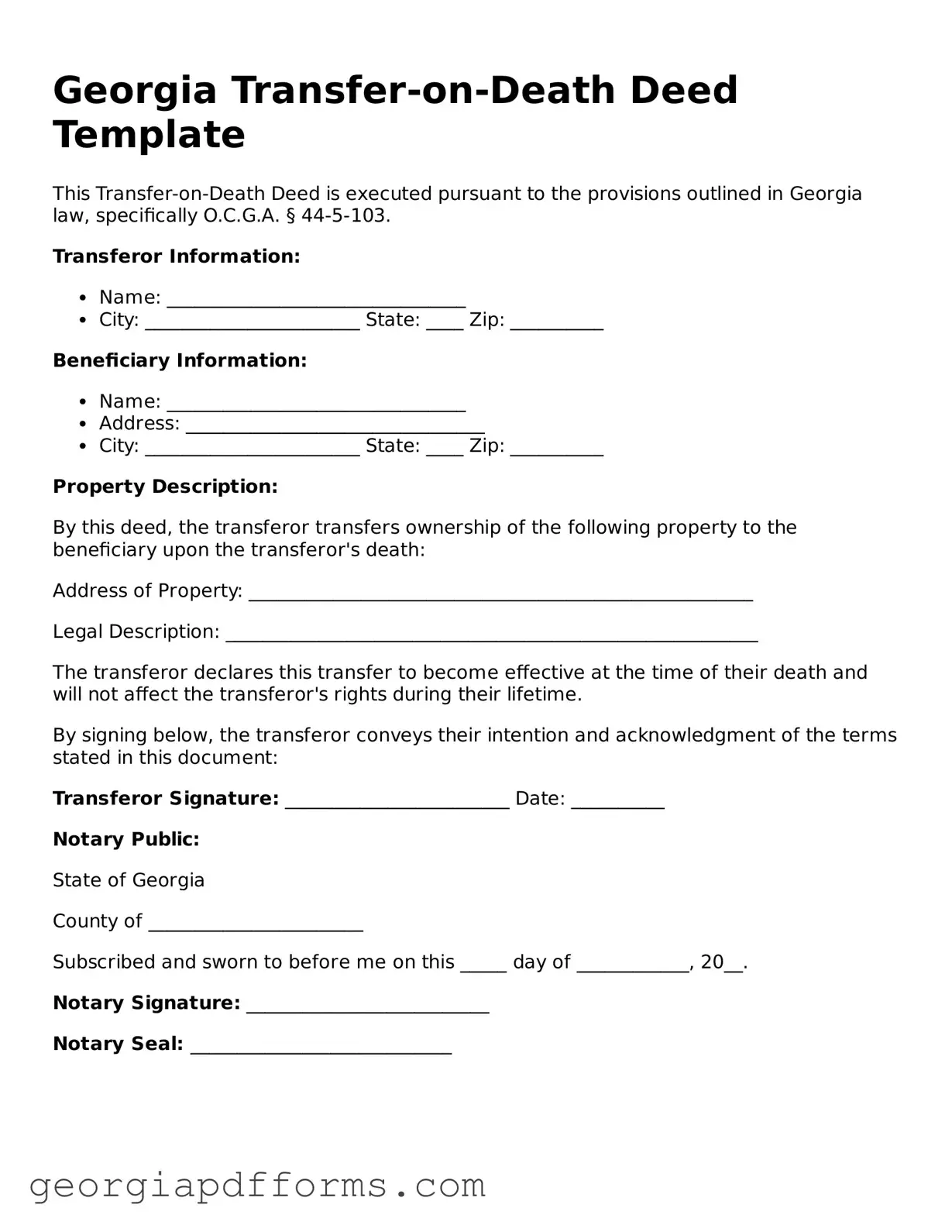

How do I fill out a Transfer-on-Death Deed?

To fill out a Transfer-on-Death Deed, you will need to provide specific information, including the names and addresses of the property owner(s), a legal description of the property, and the names of the beneficiaries. It is important to ensure that all details are accurate to avoid complications later.

Is notarization required for a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed must be signed in the presence of a notary public. This step is crucial for validating the deed and ensuring that it meets legal requirements. Additionally, witnesses may be required depending on the specific circumstances.

Do I need to file the Transfer-on-Death Deed with the county?

Yes, after completing the Transfer-on-Death Deed, it must be filed with the county clerk's office in the county where the property is located. Filing the deed ensures that it is part of the public record and can be referenced when the property is transferred to the beneficiaries.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. To revoke the deed, the owner must execute a new deed that explicitly states the revocation or follow the proper procedures to cancel the original deed.

What happens if I do not name a beneficiary in the Transfer-on-Death Deed?

If no beneficiary is named in the Transfer-on-Death Deed, the property will not be transferred as intended. Instead, it will become part of the deceased owner's estate and will be subject to probate, which can lead to delays and additional costs for the heirs.

Can I use a Transfer-on-Death Deed for all types of property?

In Georgia, a Transfer-on-Death Deed can be used for residential real estate. However, it cannot be used for personal property, bank accounts, or other types of assets. It is important to understand the limitations of this deed when planning your estate.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. However, beneficiaries may be subject to capital gains taxes when they sell the property after the owner's death. It is advisable to consult with a tax professional for personalized guidance.

How does a Transfer-on-Death Deed affect Medicaid eligibility?

A Transfer-on-Death Deed typically does not affect Medicaid eligibility, as the property does not transfer until the owner's death. However, it is essential to consider the overall estate planning strategy, as transferring assets can have implications for Medicaid qualification. Consulting with an elder law attorney can provide clarity on this matter.