What is the purpose of the ST-12B form in Georgia?

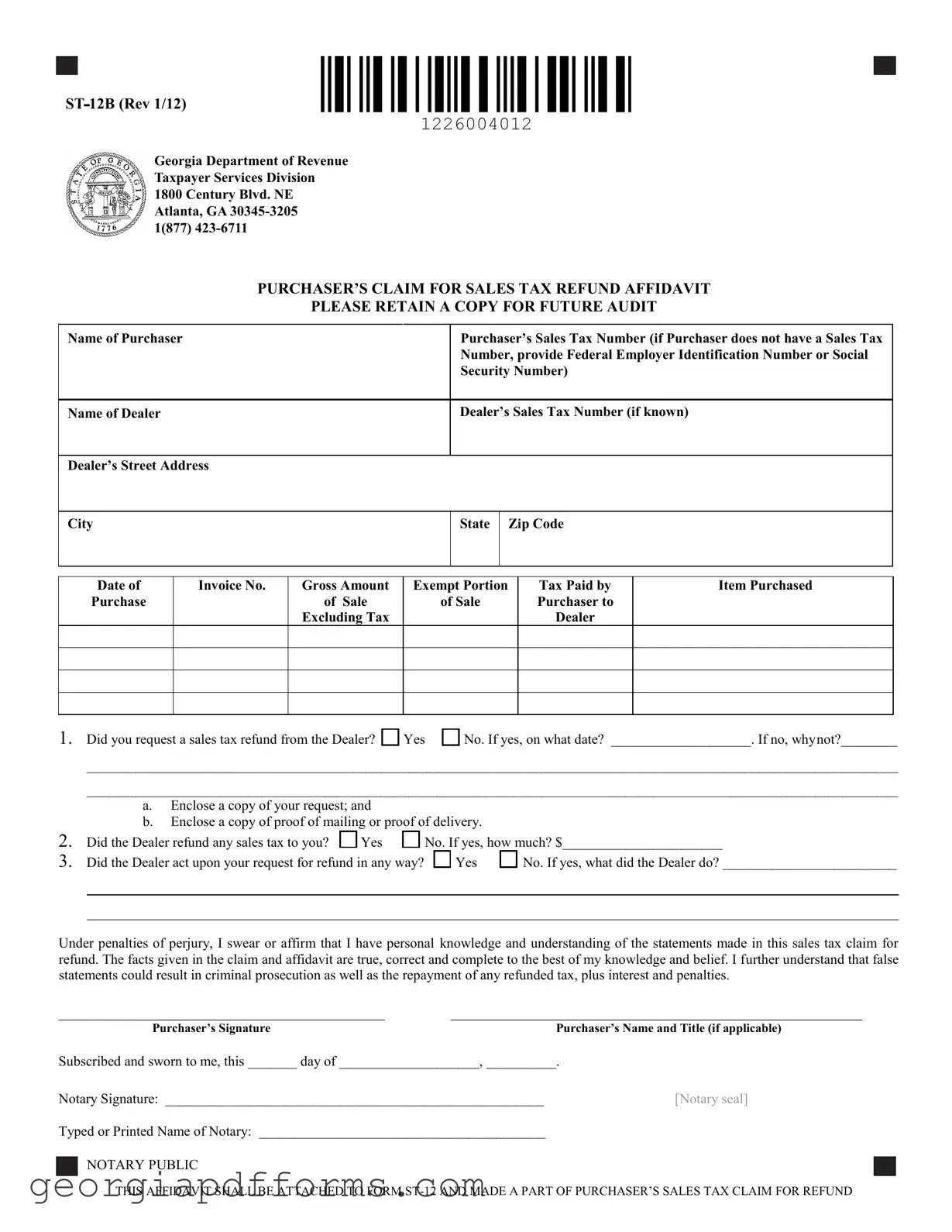

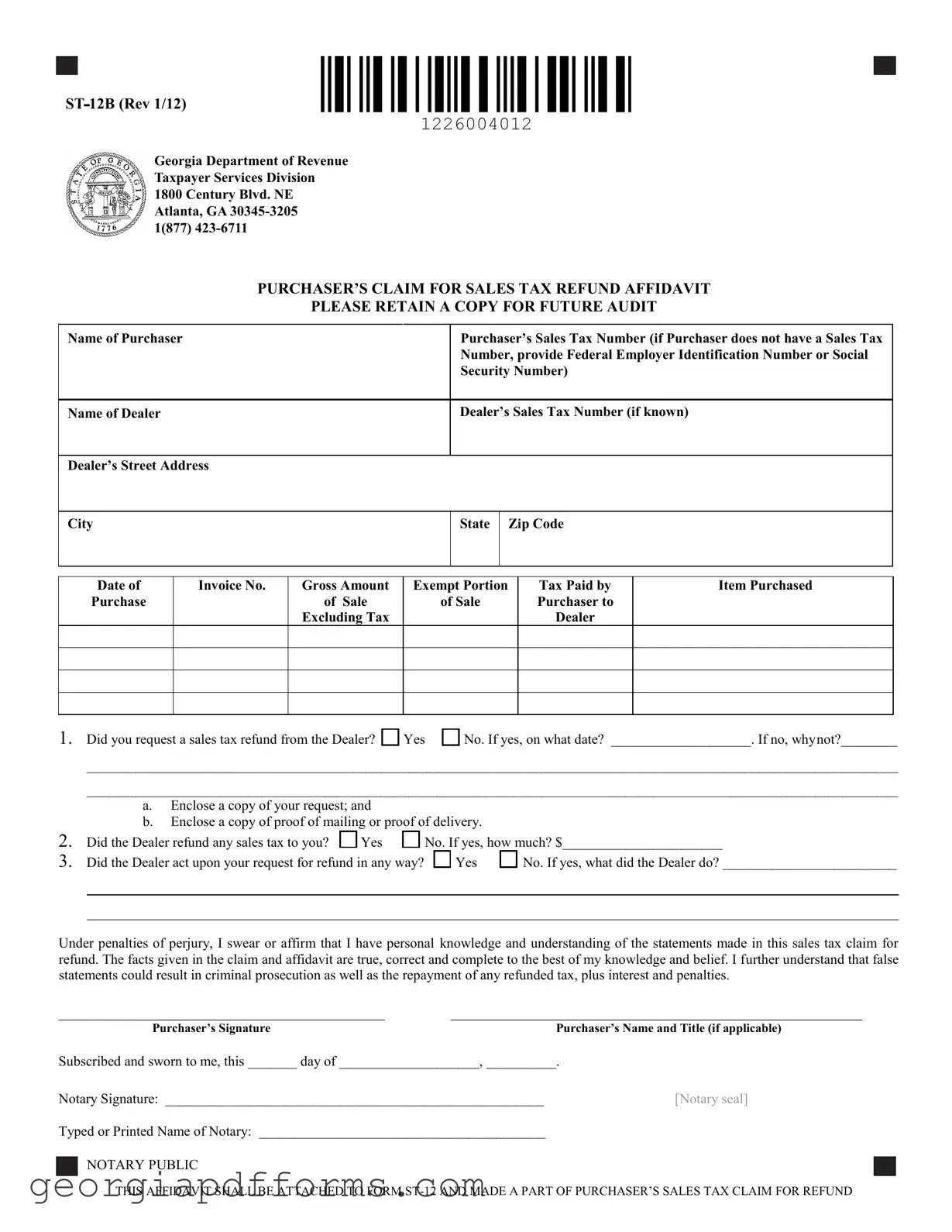

The ST-12B form serves as a Purchaser’s Claim for Sales Tax Refund Affidavit. It allows individuals or businesses to request a refund of sales tax that they believe was improperly charged during a purchase. This form is particularly important for ensuring that taxpayers can reclaim funds that they have overpaid or for which they are entitled to a refund due to exemptions. It is essential to retain a copy of this form for future audits, as it provides proof of the claim made.

What information do I need to provide on the ST-12B form?

When filling out the ST-12B form, you will need to provide several key pieces of information. This includes your name, sales tax number, or if you do not have one, your Federal Employer Identification Number (FEIN) or Social Security Number. You will also need to include the dealer's name and sales tax number, the street address, city, state, and zip code of the dealer, along with details about the purchase such as the date, invoice number, and gross amount of the sale. Additionally, you must specify the amount of tax paid and the item purchased. This thorough documentation helps to substantiate your claim for a refund.

What steps should I take before submitting the ST-12B form?

Before submitting the ST-12B form, it is crucial to take a few preparatory steps. First, determine whether you have already requested a sales tax refund from the dealer and note the date of that request. If you have not made such a request, be prepared to explain why. Additionally, gather supporting documents, such as a copy of your refund request to the dealer and proof of mailing or delivery. These documents will strengthen your claim and provide necessary evidence should any questions arise during the review process.

What happens after I submit the ST-12B form?

Once you submit the ST-12B form along with any required documentation, the Georgia Department of Revenue will review your claim. They will assess the information provided to determine whether you are eligible for a sales tax refund. If your claim is approved, you will receive a refund of the overpaid sales tax. However, if there are any discrepancies or if additional information is needed, the department may contact you for clarification. It's important to keep a copy of all submitted materials for your records and to follow up if you do not receive a response within a reasonable timeframe.

NOTARY PUBLIC

NOTARY PUBLIC