What is a Georgia Small Estate Affidavit?

A Georgia Small Estate Affidavit is a legal document that allows heirs to claim a deceased person's assets without going through the full probate process. This form is useful when the total value of the estate is below a certain threshold, making it simpler and faster to transfer property and assets to the rightful heirs.

What is the value limit for a small estate in Georgia?

In Georgia, the value limit for a small estate is $100,000 for personal property and $25,000 for real property. If the total value of the estate falls below these amounts, you can use the Small Estate Affidavit to claim assets without formal probate.

Who can use the Small Estate Affidavit?

Typically, the heirs or beneficiaries named in the deceased person's will can use the Small Estate Affidavit. If there is no will, the legal heirs according to Georgia intestacy laws can also use this form. It's important to ensure that you are eligible to claim the assets before proceeding.

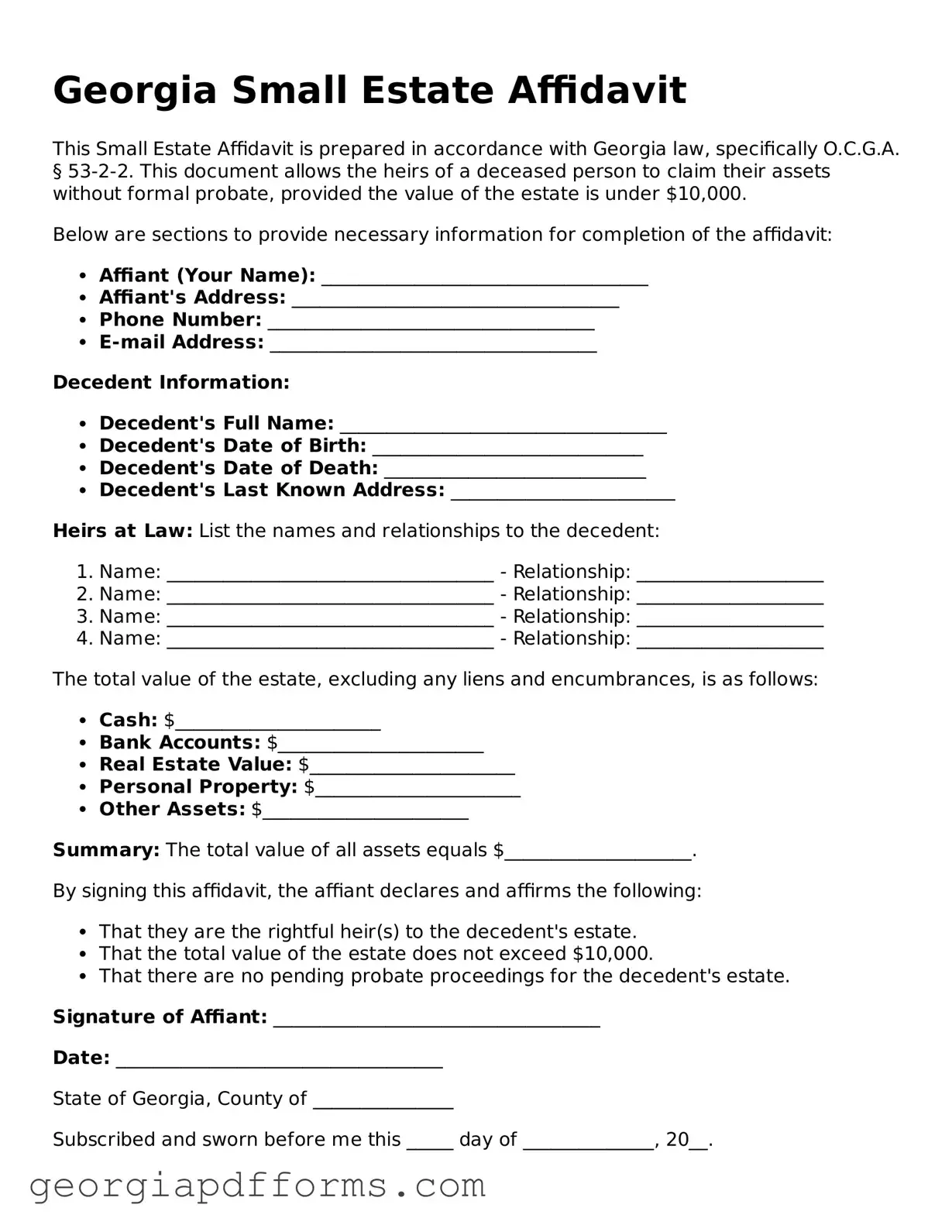

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to provide information about the deceased, the heirs, and the assets involved. You must also declare that the total value of the estate is within the small estate limits. Be sure to sign the affidavit in front of a notary public to make it legally binding.

Do I need to file the Small Estate Affidavit with the court?

No, you do not need to file the Small Estate Affidavit with the court. However, you should present it to financial institutions, banks, or any other entities holding the deceased's assets. This document acts as proof of your right to claim those assets without going through probate.

What happens if the estate value exceeds the small estate limits?

If the estate's value exceeds the small estate limits, you will need to go through the regular probate process. This involves filing a petition with the probate court and following the necessary legal procedures to settle the estate. It can take more time and may require legal assistance.

Can I use the Small Estate Affidavit for all types of assets?

The Small Estate Affidavit can be used for most types of personal property, such as bank accounts, vehicles, and personal belongings. However, it cannot be used for certain assets like real estate, which may require different legal processes. Always check the specific requirements for the assets you wish to claim.