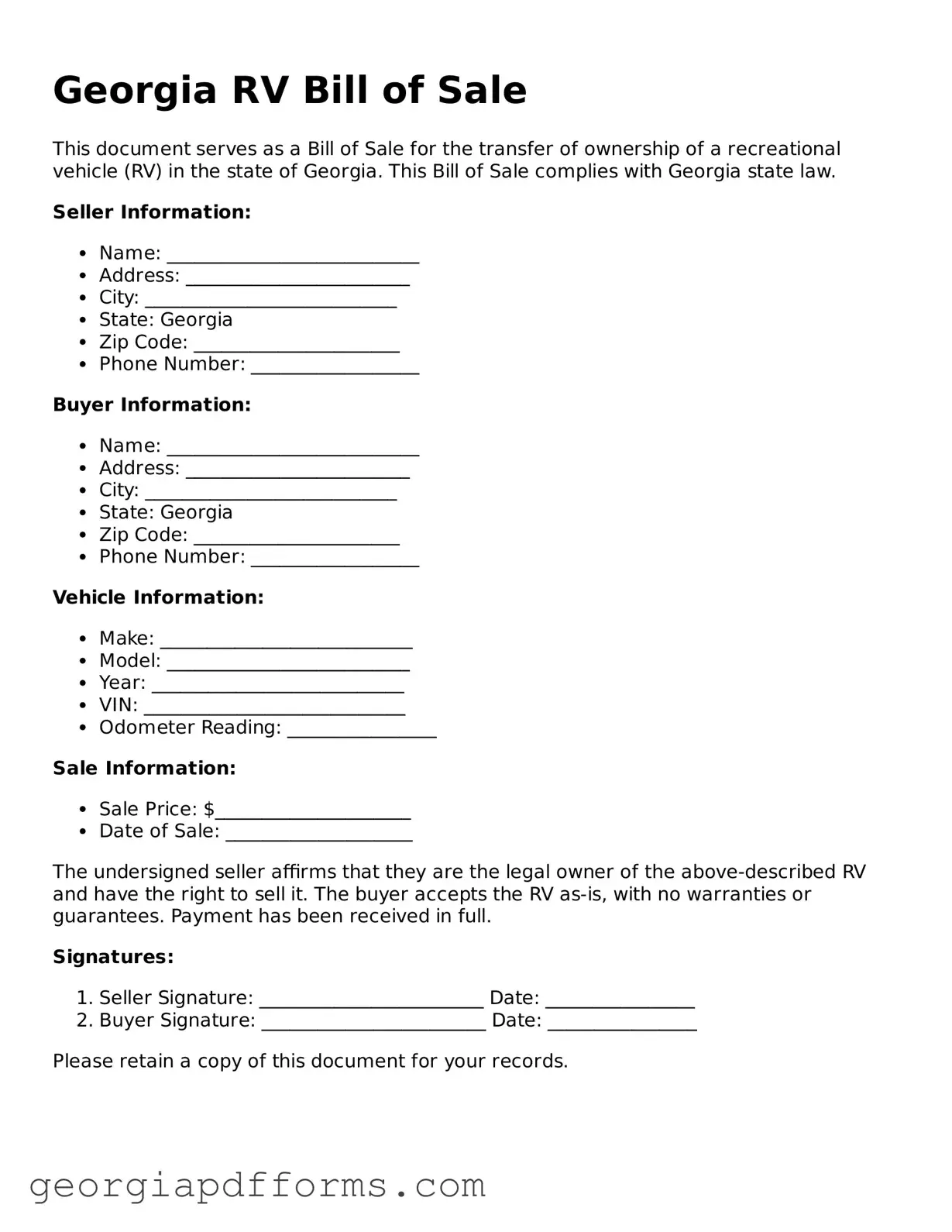

What is a Georgia RV Bill of Sale?

A Georgia RV Bill of Sale is a legal document that records the sale of a recreational vehicle (RV) between a seller and a buyer. It includes important details such as the names and addresses of both parties, the RV's description, the sale price, and the date of the transaction. This document serves as proof of ownership transfer and can be useful for registration purposes.

Is a Bill of Sale required in Georgia for RV transactions?

While a Bill of Sale is not legally required for every RV transaction in Georgia, it is highly recommended. Having a Bill of Sale provides a clear record of the sale and can protect both the buyer and seller in case of disputes. It also assists in the registration process with the Georgia Department of Revenue.

What information should be included in the RV Bill of Sale?

The RV Bill of Sale should include the following information: the full names and addresses of both the seller and buyer, the RV's make, model, year, Vehicle Identification Number (VIN), sale price, and the date of the sale. It may also include any warranties or representations made by the seller regarding the RV's condition.

Can I create my own RV Bill of Sale?

Yes, you can create your own RV Bill of Sale. However, it is important to ensure that all necessary information is included and that the document complies with Georgia laws. There are templates available online that can help guide you in drafting a proper Bill of Sale.

Do I need to have the RV Bill of Sale notarized?

Notarization is not required for an RV Bill of Sale in Georgia. However, having the document notarized can add an extra layer of security and authenticity. It may be beneficial if there are any disputes or if the buyer wants additional proof of the transaction.

What should I do with the RV Bill of Sale after the transaction?

After the transaction, both the seller and the buyer should keep a copy of the RV Bill of Sale for their records. The buyer will need this document when registering the RV with the Georgia Department of Revenue. It may also be required for insurance purposes.

What if the RV has a lien on it?

If the RV has a lien, it is important to address this before completing the sale. The seller should ensure that the lien is paid off and released prior to transferring ownership. The Bill of Sale should clearly state that the RV is being sold free of any liens, unless otherwise agreed upon.

Can I use a Georgia RV Bill of Sale in another state?

While a Georgia RV Bill of Sale can be used in another state, it is advisable to check the specific requirements of that state. Each state may have different regulations regarding vehicle sales and registrations. It may be necessary to fill out additional forms or provide further documentation when registering the RV in a different state.