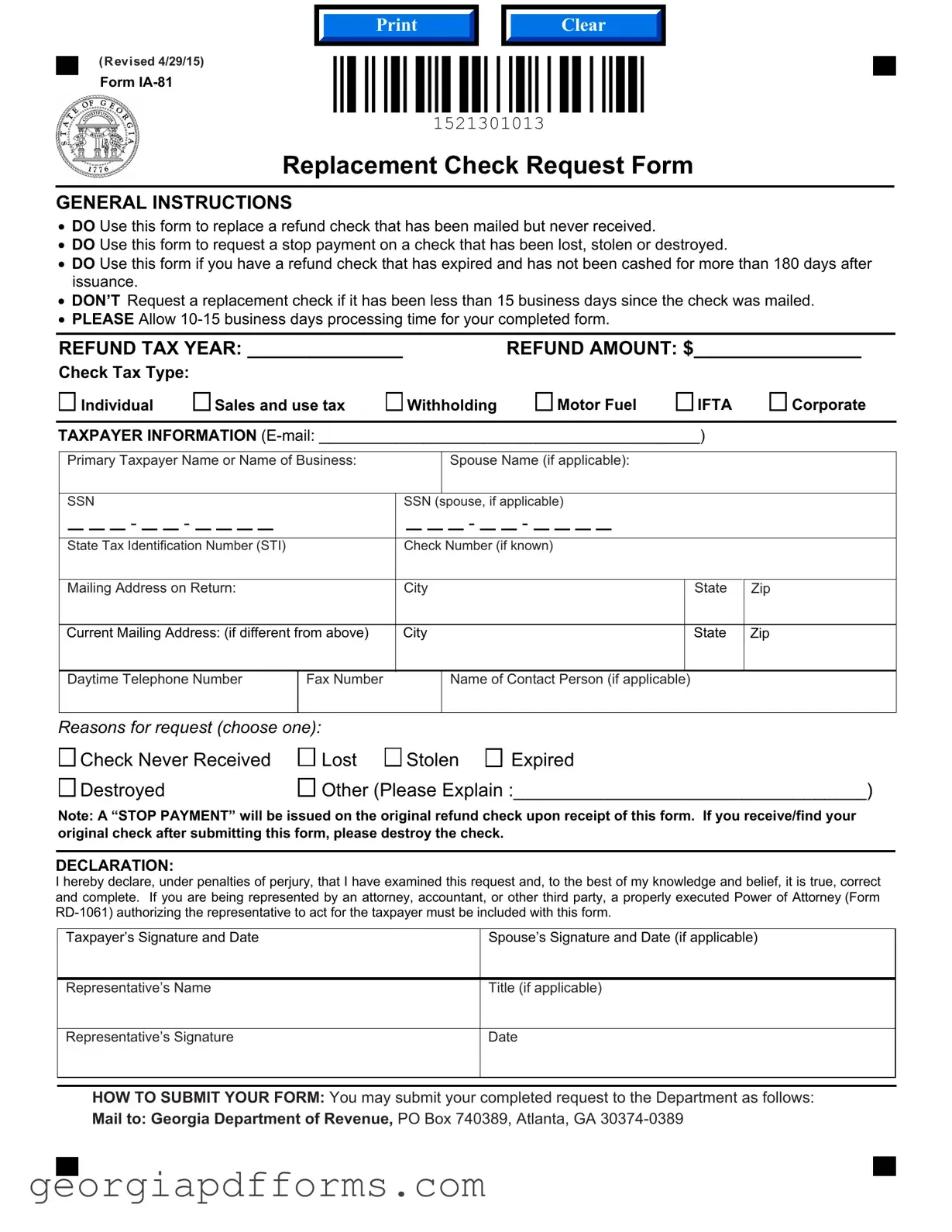

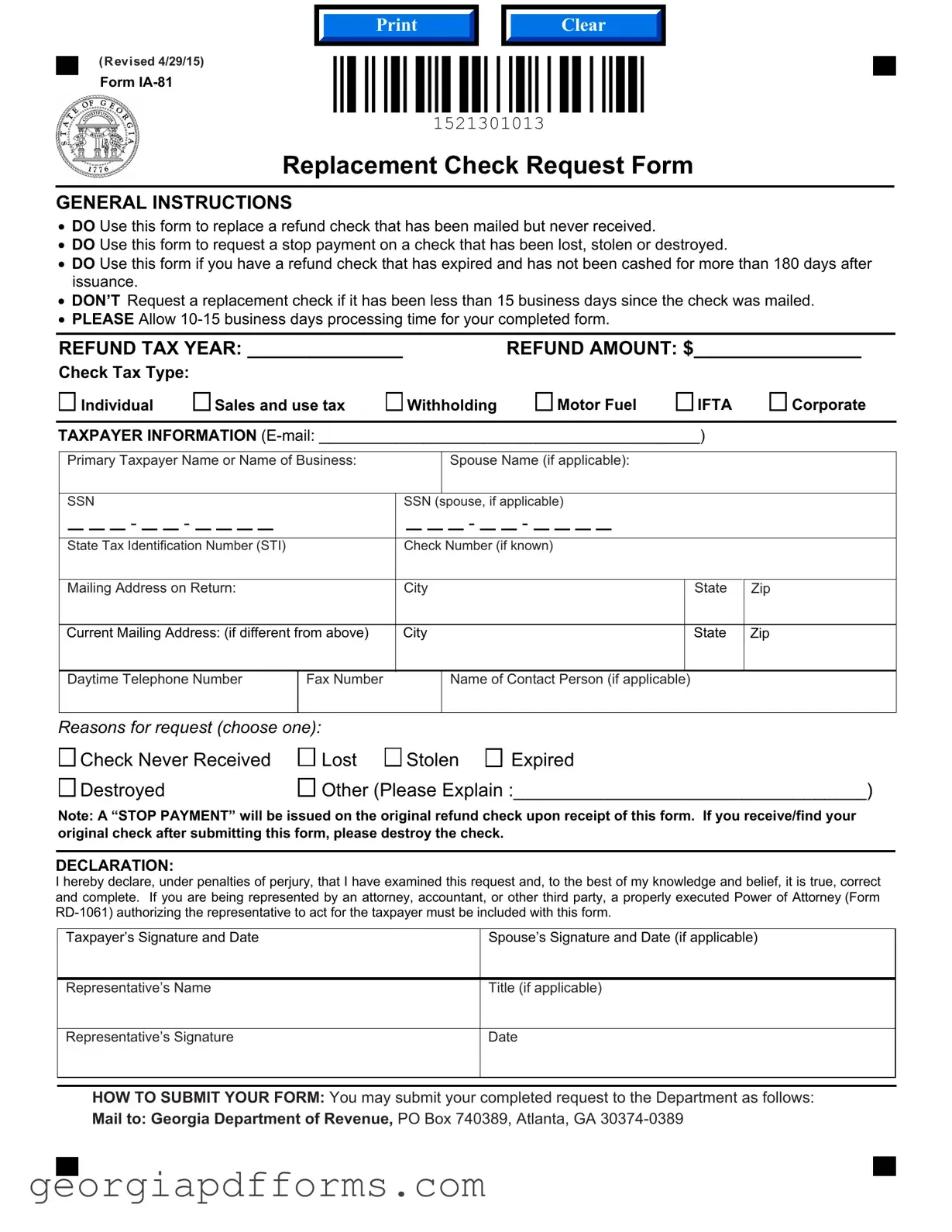

What is the purpose of the Replacement Check Request Georgia form?

This form is designed for individuals or businesses to request a replacement for a refund check that was mailed but never received. It can also be used to stop payment on a check that has been lost, stolen, or destroyed. Additionally, if a refund check has expired—meaning it has not been cashed for more than 180 days after issuance—this form is the appropriate way to request a replacement.

When should I use this form?

You should use this form if you have not received your refund check and it has been more than 15 business days since it was mailed. It is also appropriate to use if your check has been lost, stolen, or destroyed. If the check has expired, this form allows you to request a new one. Make sure to select the correct reason for your request on the form.

How long does it take to process the Replacement Check Request?

The processing time for your completed form typically takes between 10 to 15 business days. It is important to be patient during this period, as the department needs time to verify your request and issue a new check.

What information do I need to provide on the form?

You will need to provide several pieces of information, including your name or the name of your business, Social Security numbers, and details about the check, such as the refund amount and tax type. Additionally, you must include your mailing address and a daytime telephone number for any follow-up communication.

What happens if I find my original check after submitting the request?

If you find your original check after you have submitted the Replacement Check Request, do not cash it. Instead, you must return the original check to the Georgia Department of Revenue. This is important because a stop payment will have been issued on the original check, and cashing it could lead to complications.

Can someone else submit this form on my behalf?

Yes, if you are being represented by an attorney, accountant, or another third party, they can submit the form for you. However, you must include a properly executed Power of Attorney (Form RD-1061) with your request. This document authorizes the representative to act on your behalf regarding this matter.

How do I submit my completed form?

You can submit your completed Replacement Check Request form to the Georgia Department of Revenue either by mailing it to their designated address or by faxing it. The mailing address is Georgia Department of Revenue, 1800 Century Center Blvd NE, Suite 3104, Atlanta, GA 30345-3212. If you choose to fax, the number is 404-417-4391.