What is a Georgia Promissory Note?

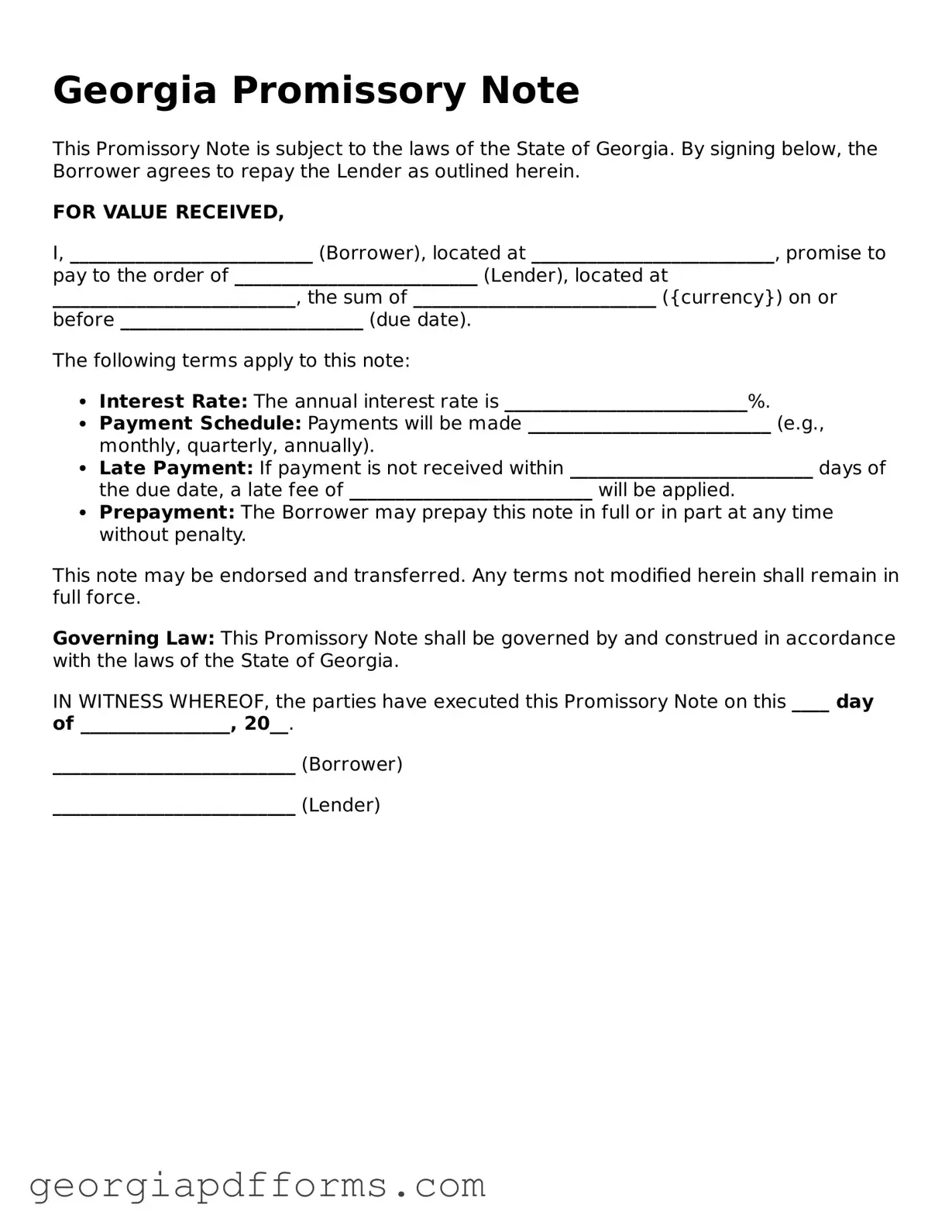

A Georgia Promissory Note is a legal document in which one party (the borrower) agrees to repay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the loan amount, interest rate, repayment schedule, and any other conditions relevant to the loan. It serves as a written record of the transaction and can be enforced in a court of law if necessary.

What are the essential components of a Georgia Promissory Note?

Essential components of a Georgia Promissory Note include the names and addresses of both the borrower and lender, the principal amount of the loan, the interest rate (if applicable), the repayment schedule, and any collateral that may secure the loan. Additionally, it is important to include a date and signatures from both parties to validate the agreement.

Is it necessary to have a lawyer draft a Promissory Note in Georgia?

While it is not legally required to have a lawyer draft a Promissory Note, it is highly advisable. A legal professional can ensure that the document complies with state laws and adequately protects the interests of both parties. This can help prevent misunderstandings and disputes down the line.

Can a Georgia Promissory Note be modified after it is signed?

Yes, a Georgia Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best practice to document any modifications in writing and have both parties sign the amended agreement. This helps maintain clarity and prevents potential conflicts regarding the terms of the loan.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing other collection methods. The specific steps depend on the terms outlined in the Promissory Note and applicable state laws.

Are there any specific laws governing Promissory Notes in Georgia?

Yes, Promissory Notes in Georgia are governed by the Uniform Commercial Code (UCC), which provides a framework for commercial transactions, including loans. This code outlines the rights and responsibilities of both lenders and borrowers, ensuring that transactions are conducted fairly and legally. It is important to be aware of these regulations when creating or entering into a Promissory Note.