Official Loan Agreement Document for Georgia State

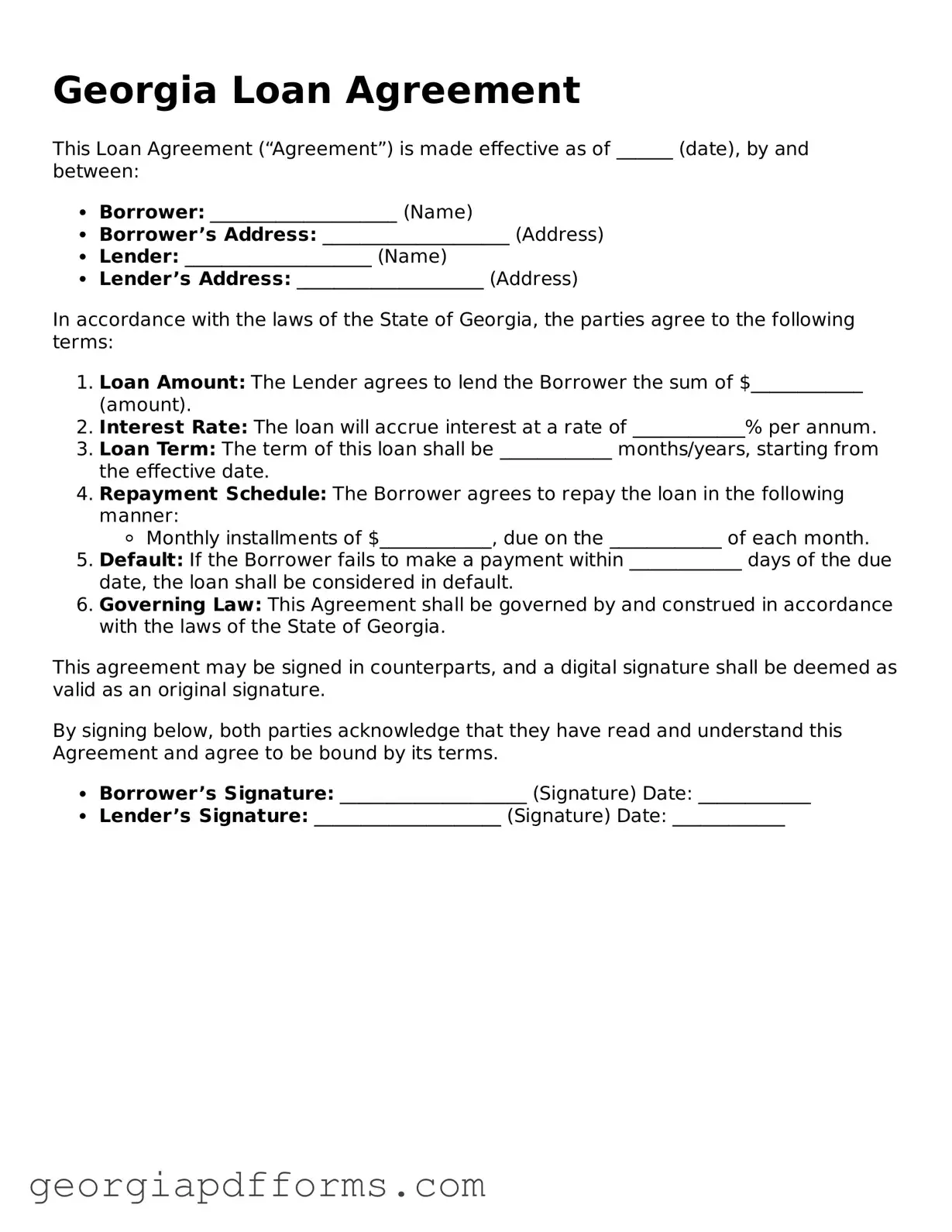

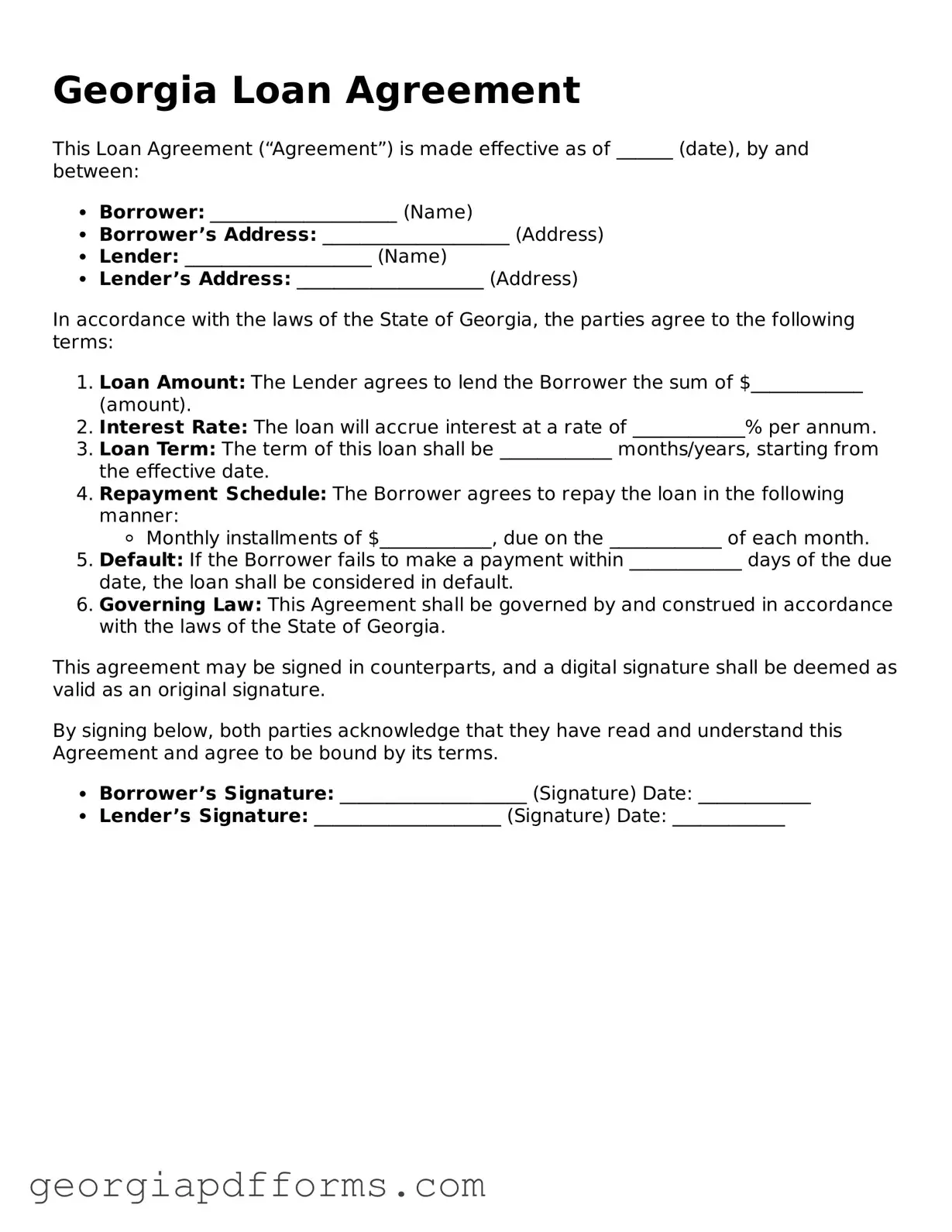

A Georgia Loan Agreement form is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender. This form serves as a crucial tool for both parties, ensuring clarity and protection throughout the loan process. By detailing the repayment schedule, interest rates, and any collateral involved, it establishes a clear framework for the financial transaction.

Access Editor Now

Official Loan Agreement Document for Georgia State

Access Editor Now

Almost there — finish the form

Fill and complete Loan Agreement online fast.

Access Editor Now

or

Free PDF File