What is a Golf Cart Bill of Sale in Georgia?

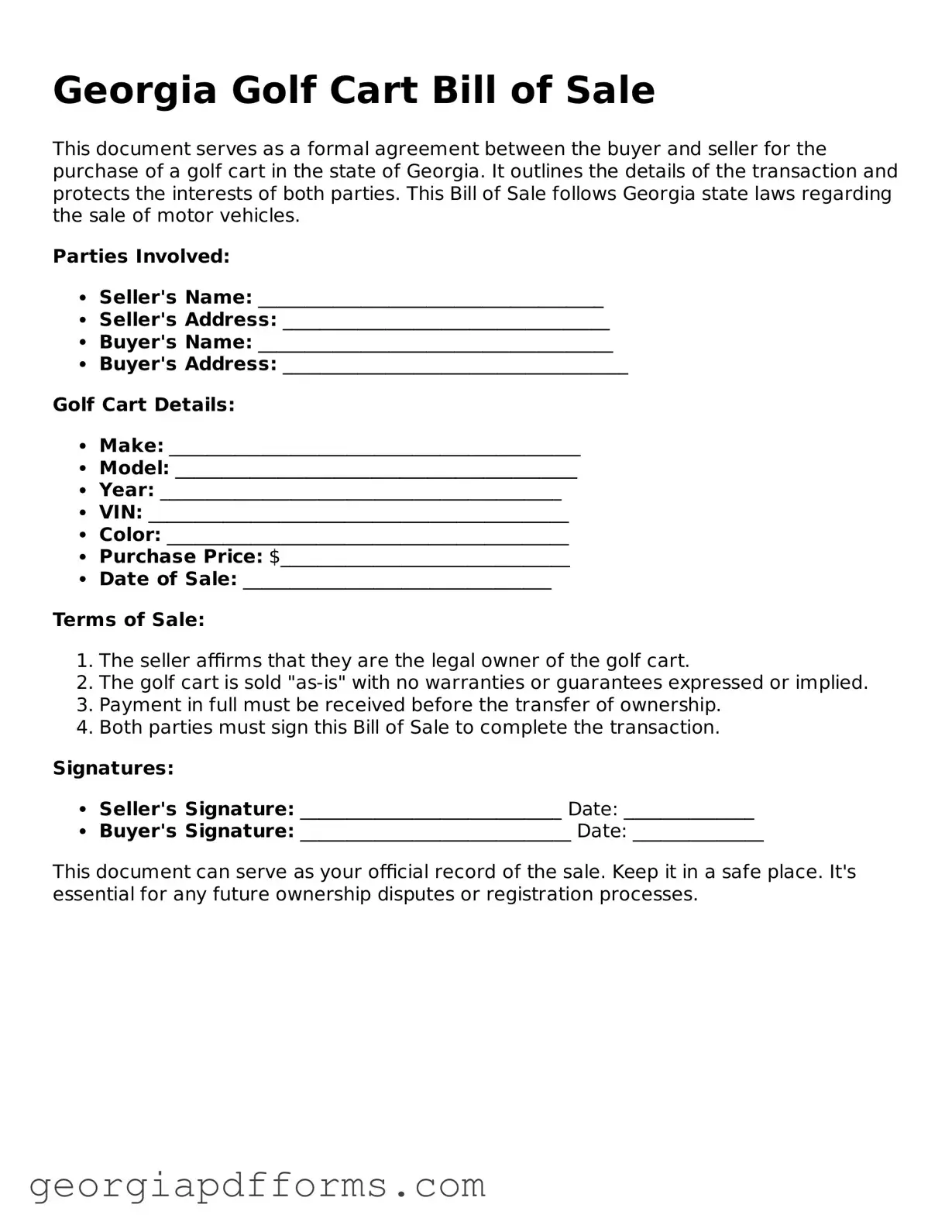

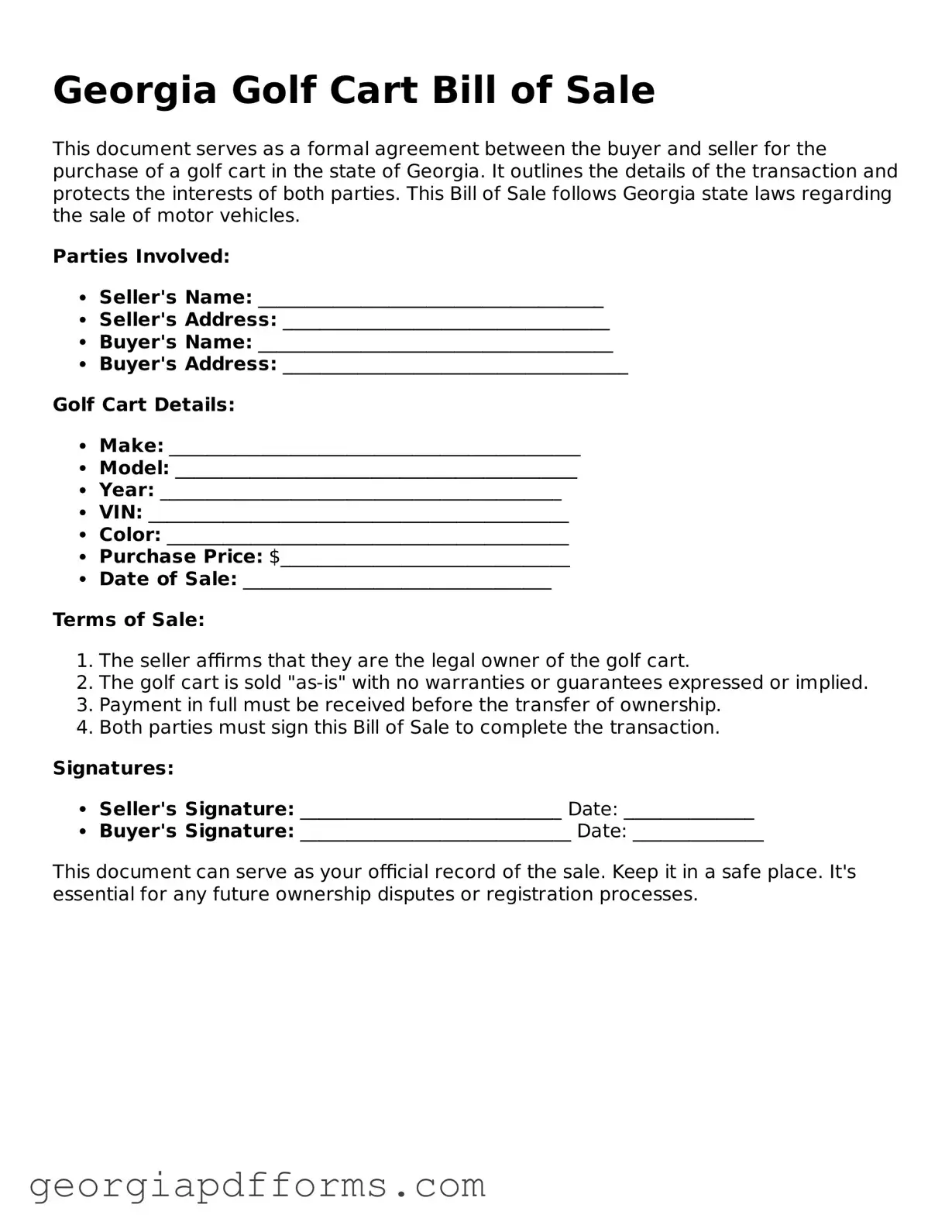

A Golf Cart Bill of Sale is a legal document that records the sale of a golf cart from one party to another in Georgia. This form serves as proof of the transaction and includes essential details such as the buyer's and seller's information, the golf cart's description, and the sale price. Having this document can protect both parties in case of disputes or misunderstandings regarding the sale.

Is a Golf Cart Bill of Sale required in Georgia?

While a Golf Cart Bill of Sale is not legally required in Georgia, it is highly recommended. This document provides a clear record of the transaction, which can be crucial for future reference. It can also help in transferring ownership and registering the golf cart if necessary. Without it, you may face challenges proving ownership or the terms of the sale.

What information should be included in the Golf Cart Bill of Sale?

The Golf Cart Bill of Sale should include several key pieces of information: the names and addresses of both the buyer and seller, the date of the transaction, a detailed description of the golf cart (including make, model, year, and vehicle identification number), the sale price, and any warranties or conditions of the sale. Including all this information helps ensure clarity and protects both parties.

Can I create my own Golf Cart Bill of Sale?

Yes, you can create your own Golf Cart Bill of Sale. However, it is essential to ensure that it includes all necessary information and complies with any relevant state laws. There are many templates available online that can guide you in drafting a comprehensive document. Just make sure to customize it to reflect the specifics of your transaction.

Do I need to have the Golf Cart Bill of Sale notarized?

No, notarization is not required for a Golf Cart Bill of Sale in Georgia. However, having the document notarized can add an extra layer of authenticity and may be beneficial if there are any disputes in the future. It can also provide peace of mind to both the buyer and seller, knowing that the transaction is documented properly.

What should I do after completing the Golf Cart Bill of Sale?

After completing the Golf Cart Bill of Sale, both the buyer and seller should keep a copy for their records. The seller may also want to inform their local Department of Motor Vehicles (DMV) about the sale, especially if the golf cart is registered. The buyer should ensure they have all necessary documents for registration and insurance purposes, if applicable.

Are there any taxes associated with the sale of a golf cart in Georgia?

Yes, there may be taxes associated with the sale of a golf cart in Georgia. The buyer may be required to pay sales tax based on the purchase price. It's important to check with your local tax authority or the Georgia Department of Revenue for specific details regarding tax obligations related to golf cart sales.

What if the golf cart has a lien on it?

If the golf cart has a lien, it is crucial to address this before completing the sale. The seller should clear the lien or disclose it to the buyer. Failing to do so can lead to complications for the buyer, who may find themselves responsible for the debt. Always ensure that the title is clear and free of any encumbrances before proceeding with the sale.