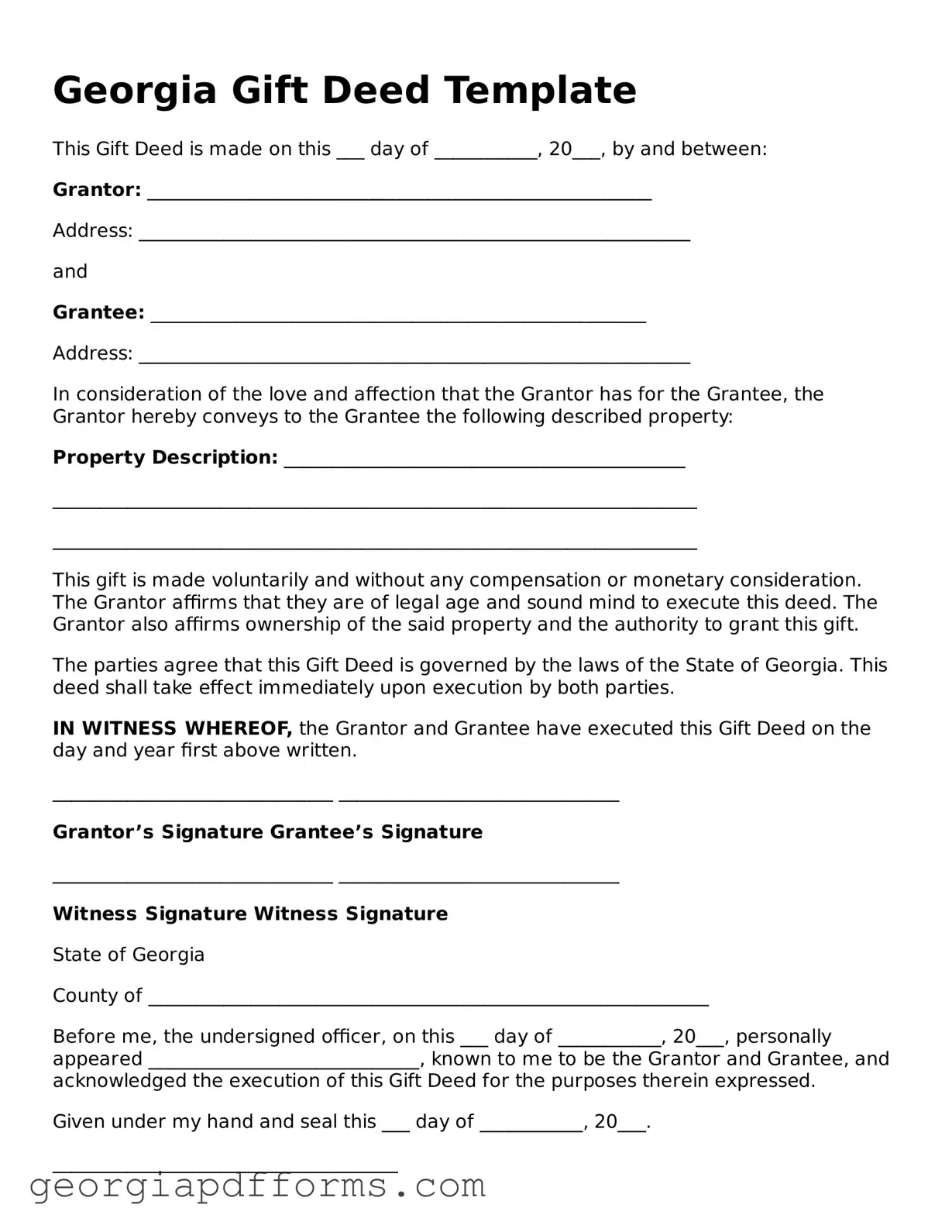

Official Gift Deed Document for Georgia State

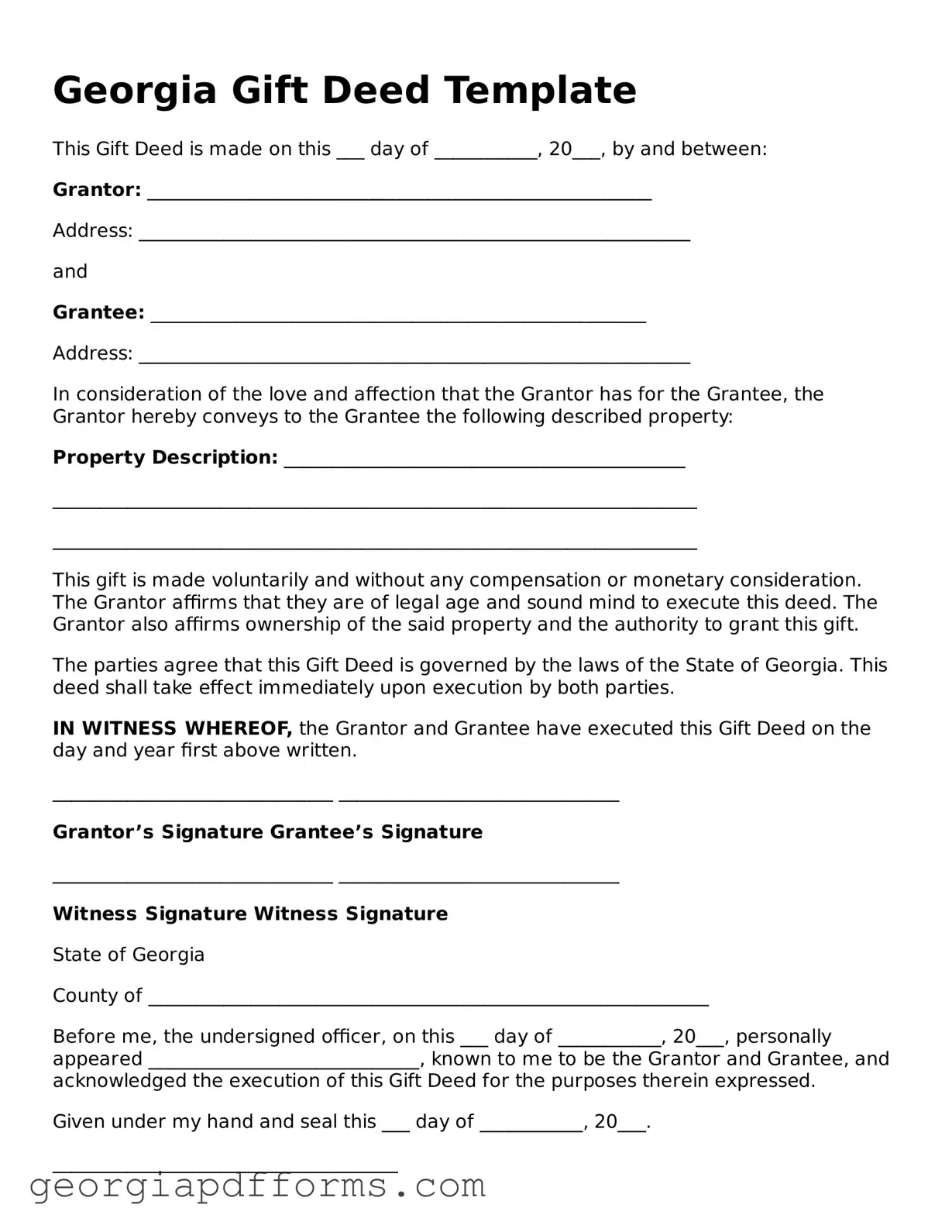

A Georgia Gift Deed form is a legal document used to transfer ownership of property as a gift without any exchange of money. This form ensures that the transfer is documented properly and is recognized by the state. Understanding the requirements and implications of using a Gift Deed is essential for both the giver and the recipient.

Access Editor Now

Official Gift Deed Document for Georgia State

Access Editor Now

Almost there — finish the form

Fill and complete Gift Deed online fast.

Access Editor Now

or

Free PDF File