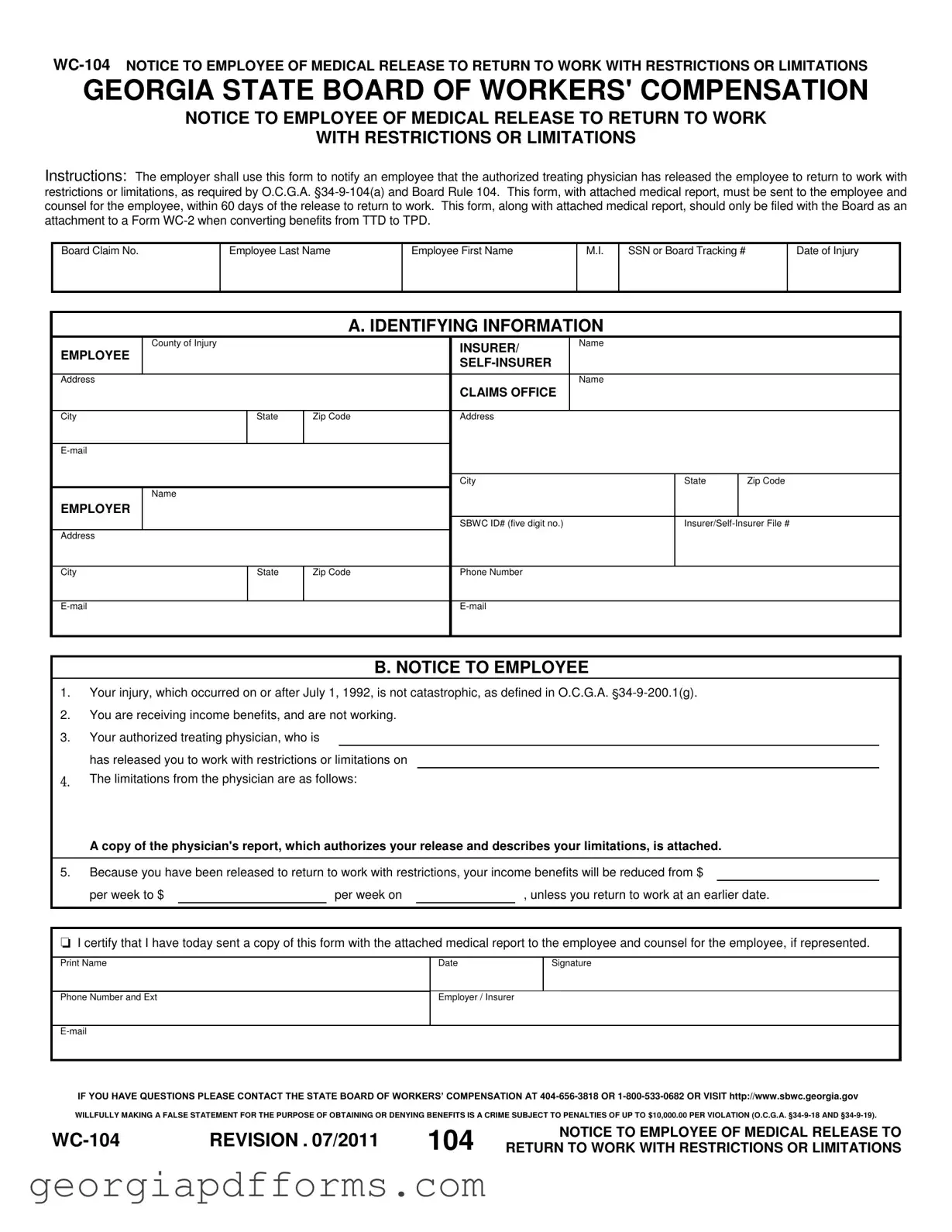

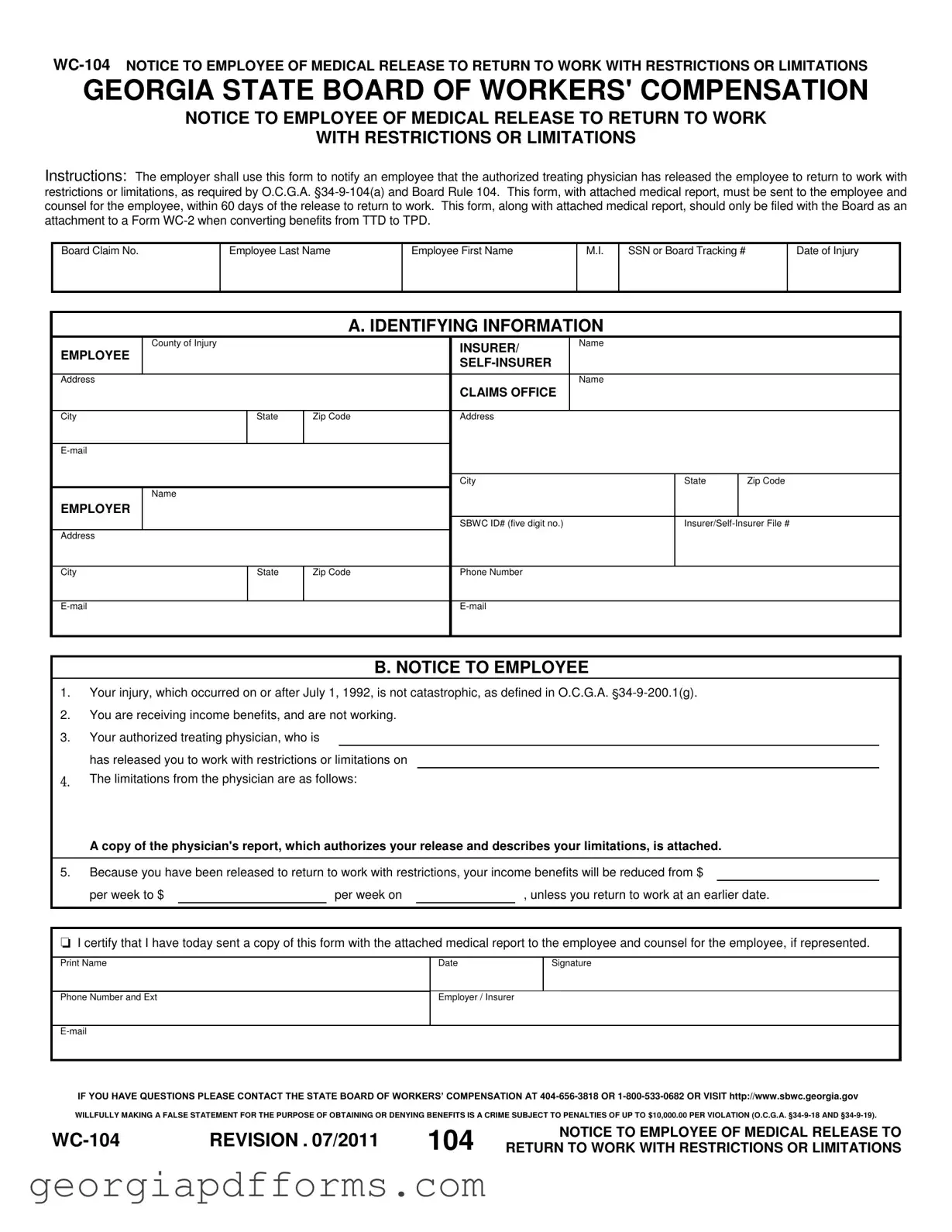

What is the purpose of the Georgia WC-104 form?

The Georgia WC-104 form serves as a notification to employees that their authorized treating physician has cleared them to return to work, albeit with certain restrictions or limitations. This form ensures that employees are informed about their medical status and any necessary accommodations that may be required in their workplace. It is a crucial document in the workers' compensation process, helping to facilitate a smooth transition back to work.

Who is responsible for completing and sending the WC-104 form?

The employer is responsible for completing the WC-104 form. They must send it to the employee and, if applicable, the employee’s legal counsel. This notification must occur within 60 days of the physician’s release to return to work. Timely communication is essential to comply with Georgia's workers' compensation laws.

What information is included in the WC-104 form?

The WC-104 form includes identifying information about the employee, such as their name, Social Security number, and date of injury. It also contains details about the employer and insurer, as well as specific information regarding the medical release, including any restrictions or limitations set forth by the physician. A copy of the physician's report is typically attached to this form.

What happens if an employee is released to work with restrictions?

If an employee is released to work with restrictions, their income benefits may be adjusted. The WC-104 form will specify the new benefit amount, which will be reduced unless the employee returns to work earlier than the date indicated. This adjustment reflects the change in the employee's work status and is an important aspect of managing their benefits during recovery.

Can the WC-104 form be filed with the Georgia State Board of Workers' Compensation?

The WC-104 form itself is not directly filed with the Georgia State Board of Workers' Compensation. Instead, it is used as an attachment to a Form WC-2 when converting benefits from Temporary Total Disability (TTD) to Temporary Partial Disability (TPD). This ensures that the Board has all necessary documentation regarding the employee’s return to work and any associated changes in benefits.

What should an employee do if they have questions about the WC-104 form?

If an employee has questions regarding the WC-104 form or their workers' compensation benefits, they should contact the State Board of Workers’ Compensation. They can reach out via phone at 404-656-3818 or 1-800-533-0682. Additionally, employees can visit the Board's website for more information and resources related to their situation.

What are the consequences of providing false information on the WC-104 form?

Providing false information on the WC-104 form is a serious offense. Willfully making a false statement to obtain or deny benefits can lead to penalties of up to $10,000 per violation. This emphasizes the importance of honesty and accuracy when completing any documentation related to workers' compensation claims.