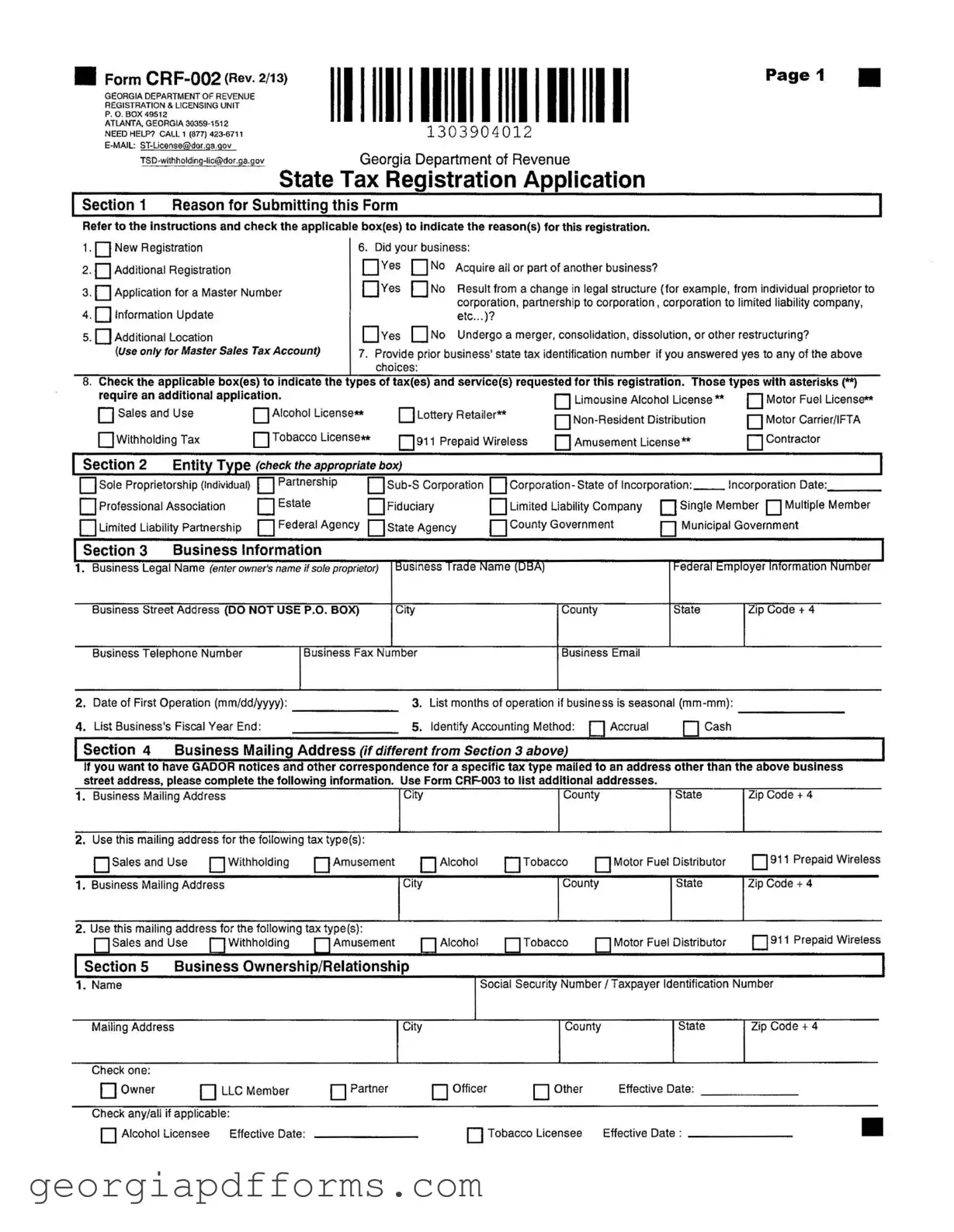

What is the purpose of the Georgia State Tax Instruction form?

The Georgia State Tax Instruction form, specifically Form CRF-002, is used to register a business for various state taxes. It allows individuals and entities to provide necessary information regarding their business operations, ownership structure, and the types of taxes they will be subject to. This form is essential for compliance with state tax regulations.

Who needs to submit this form?

This form must be submitted by any business entity that is starting operations in Georgia, changing its legal structure, or acquiring another business. Additionally, businesses that need to update their information or register for additional tax types should also complete this form. It is important for both new and existing businesses to ensure they are properly registered for state tax purposes.

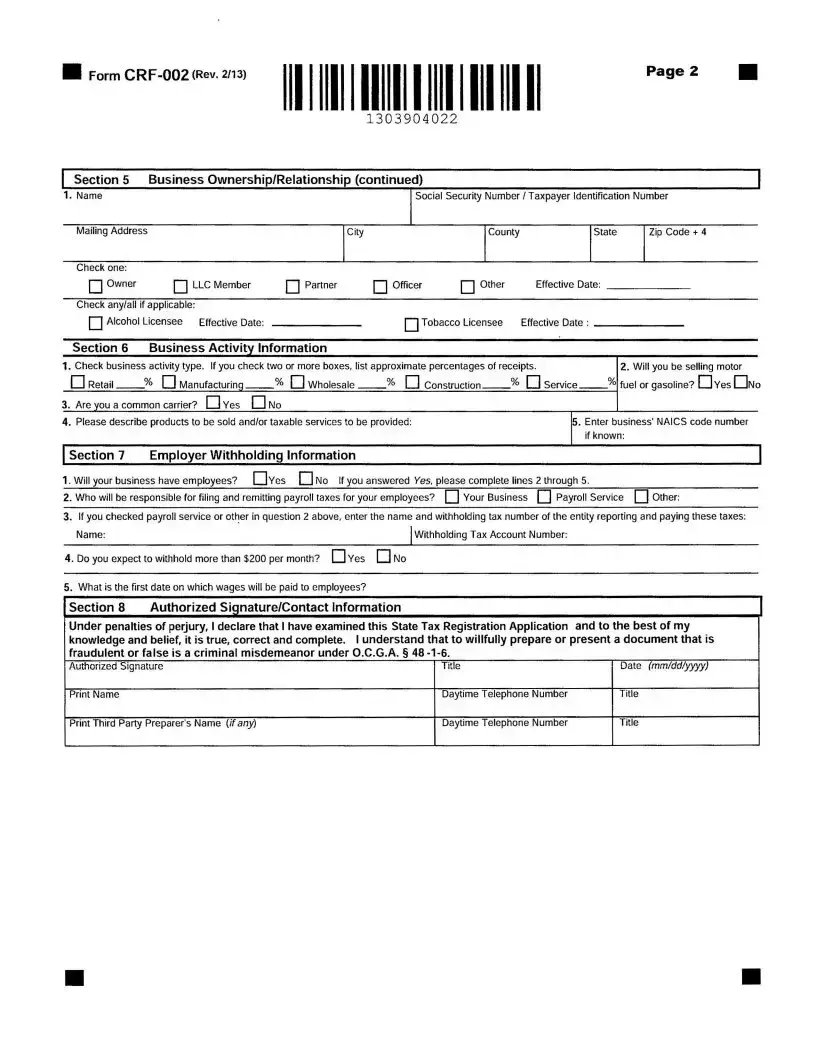

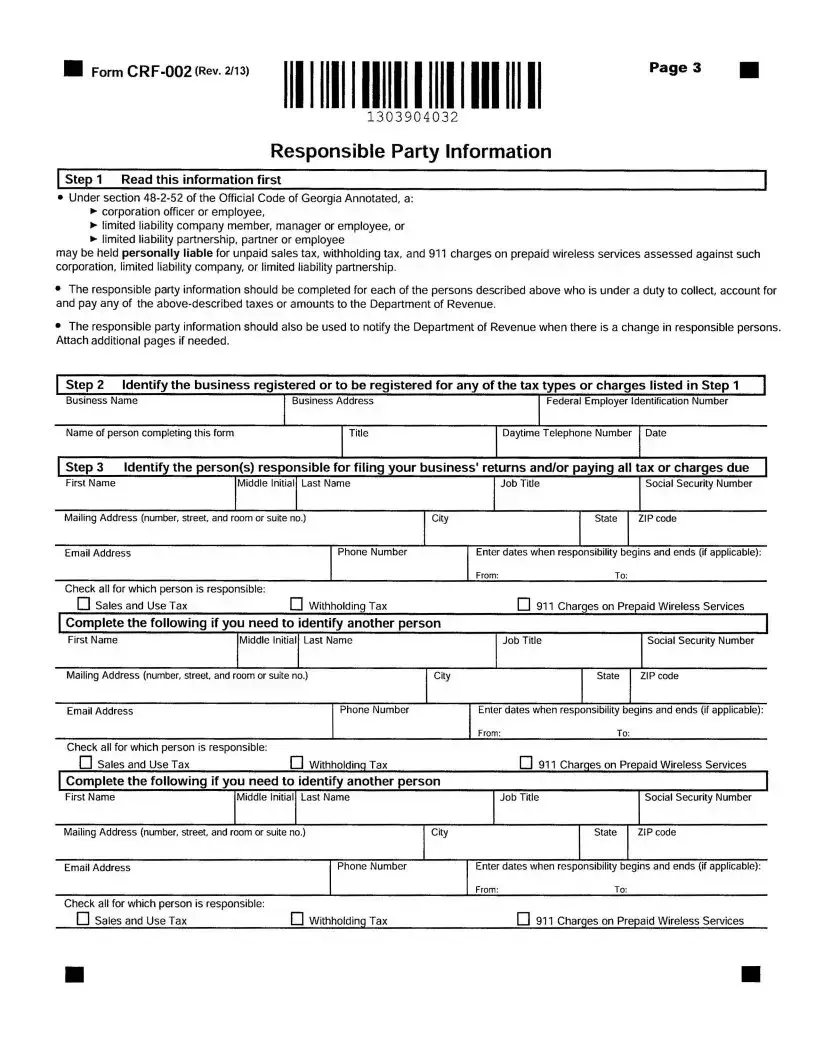

What information is required on the form?

The form requires various details, including the business's legal and trade names, address, entity type, and ownership information. Applicants must also indicate the reason for submitting the form, such as new registration or updates. Specific tax types being requested must be checked, and information about the business's activities and employees is also necessary.

How does one determine the appropriate entity type to select?

When completing the form, applicants should choose the entity type that accurately reflects their business structure. Options include sole proprietorship, partnership, corporation, limited liability company, and others. It is advisable to consult with a tax professional or legal advisor if unsure about the correct classification, as this can impact tax obligations and liabilities.

What should be done if there are changes in business ownership or structure?

If there are changes in ownership or the legal structure of the business, the responsible party must update the Georgia Department of Revenue by submitting a new registration form. This ensures that the tax records are current and reflect the new ownership or structure. It is important to maintain accurate records to avoid potential legal issues related to tax liabilities.

Is there a fee associated with submitting the form?

There is no fee specifically for submitting the Georgia State Tax Instruction form. However, certain types of registrations, such as those for licenses that require additional applications, may involve fees. It is advisable to review the specific requirements for each tax type to understand any associated costs.

Where can I submit the completed form?

The completed form should be mailed to the Georgia Department of Revenue at the address provided on the form: Registration & Licensing Unit, P.O. Box 49512, Atlanta, Georgia. It is recommended to keep a copy of the submitted form for your records. Additionally, check the Department of Revenue’s website for any updates regarding submission methods or requirements.