Fill a Valid Georgia Hire Reporting Template

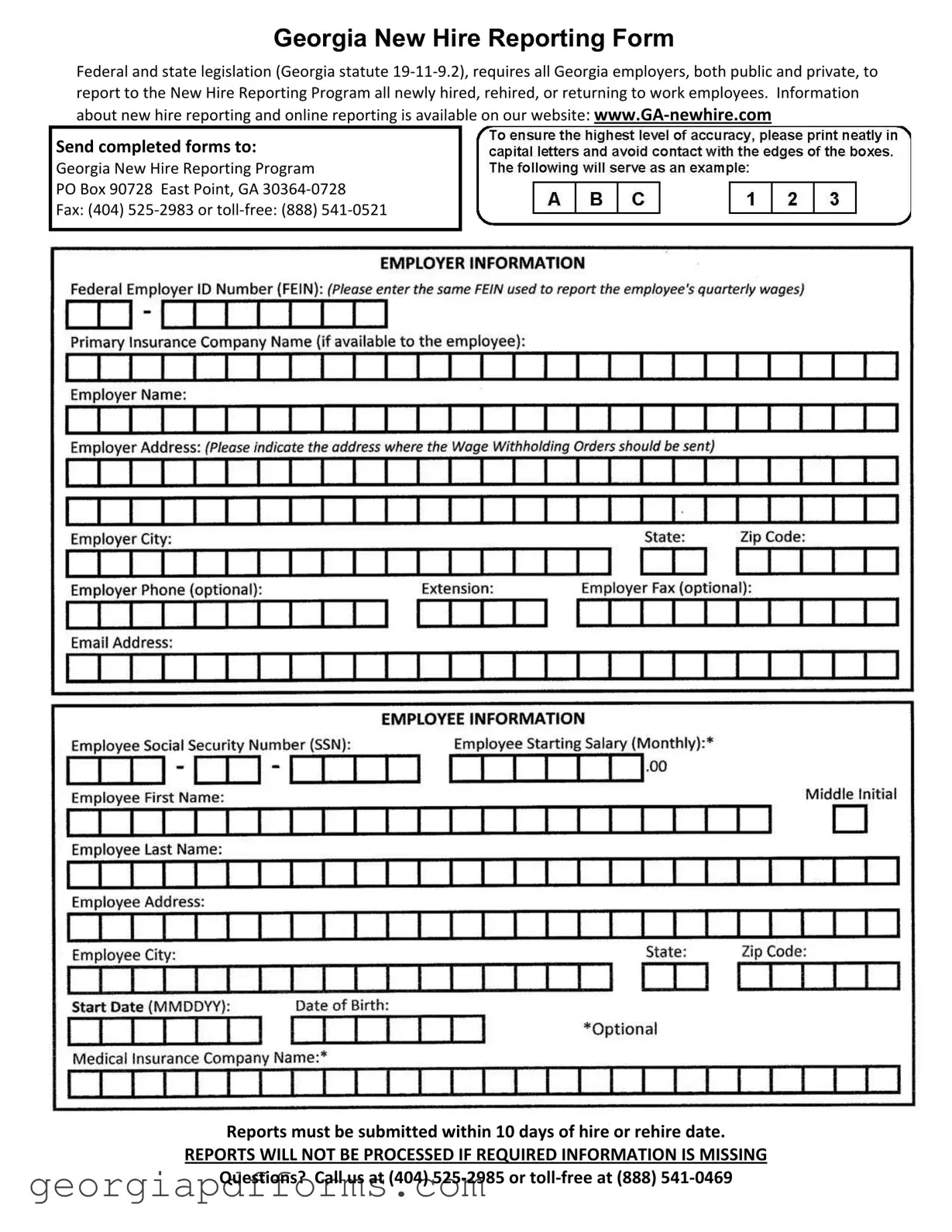

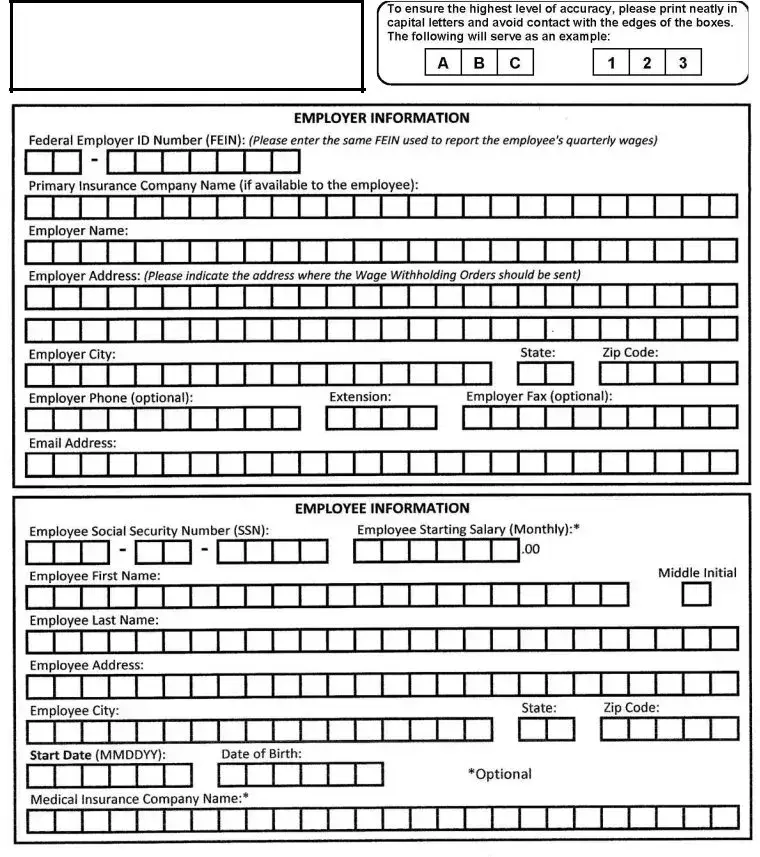

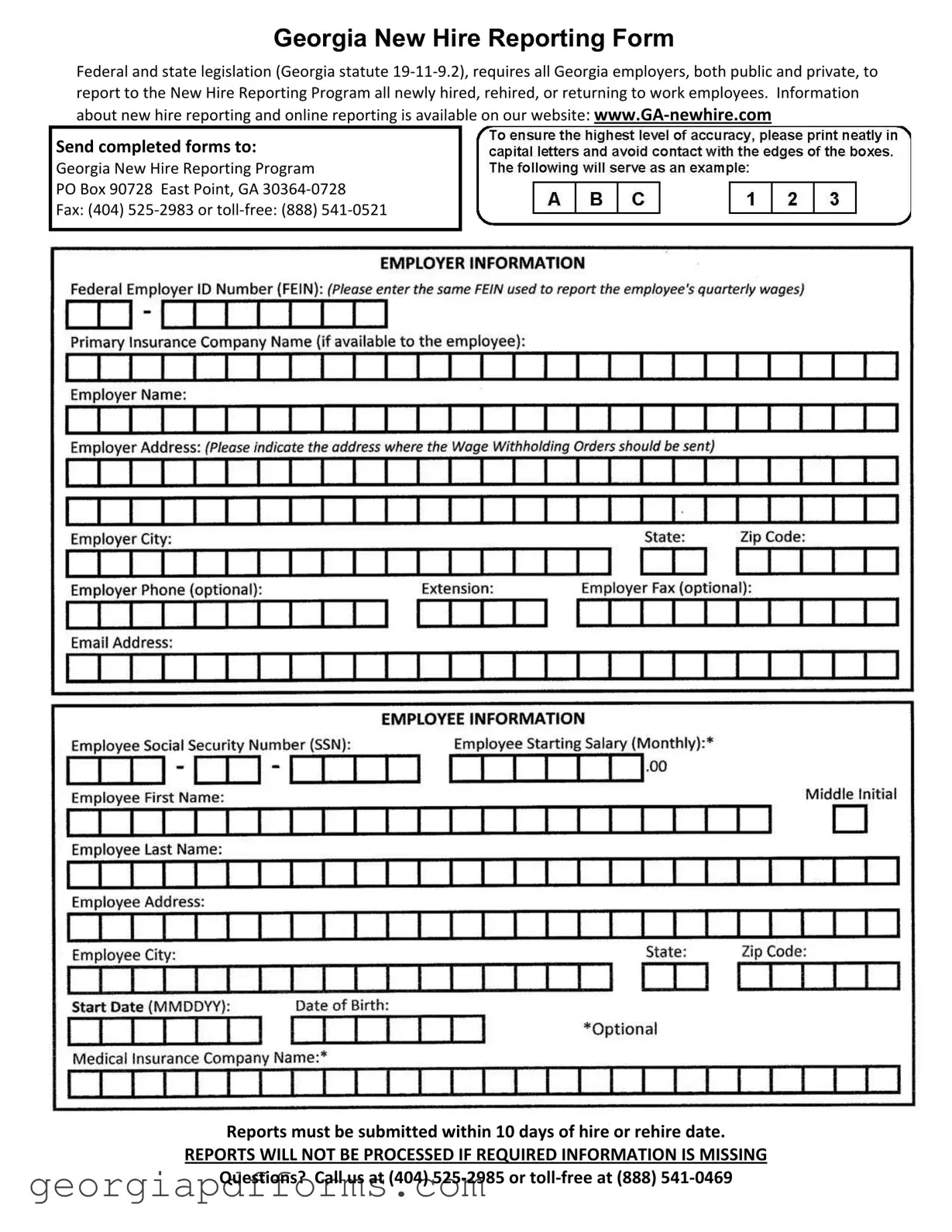

The Georgia Hire Reporting Form is a document required by both federal and state laws that mandates all employers in Georgia to report newly hired, rehired, or returning employees to the New Hire Reporting Program. This process ensures compliance with Georgia statute 19‐11‐9.2 and must be completed within 10 days of the employee's start date. For assistance or more information, employers can visit the New Hire Reporting website or reach out via phone.

Access Editor Now

Fill a Valid Georgia Hire Reporting Template

Access Editor Now

Almost there — finish the form

Fill and complete Georgia Hire Reporting online fast.

Access Editor Now

or

Free PDF File