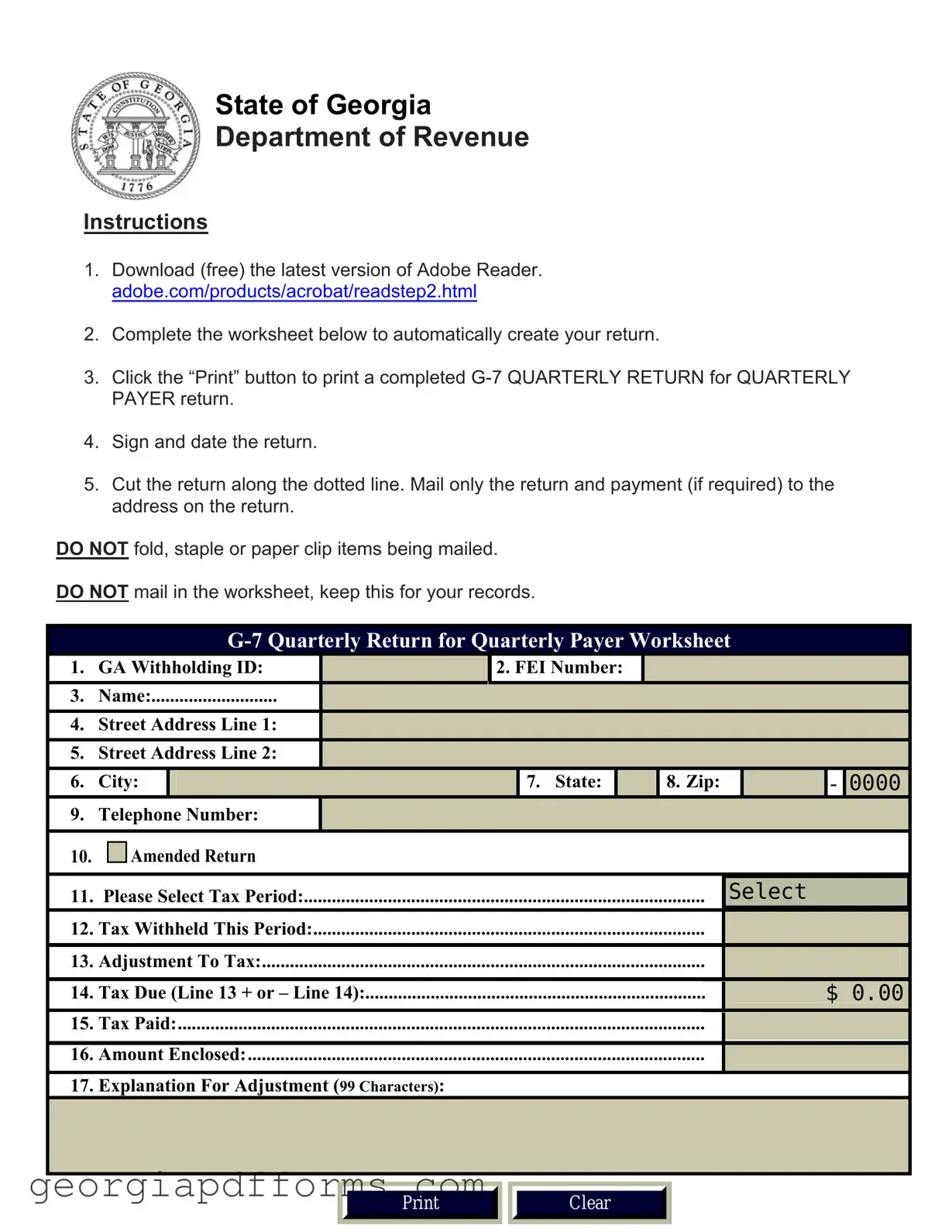

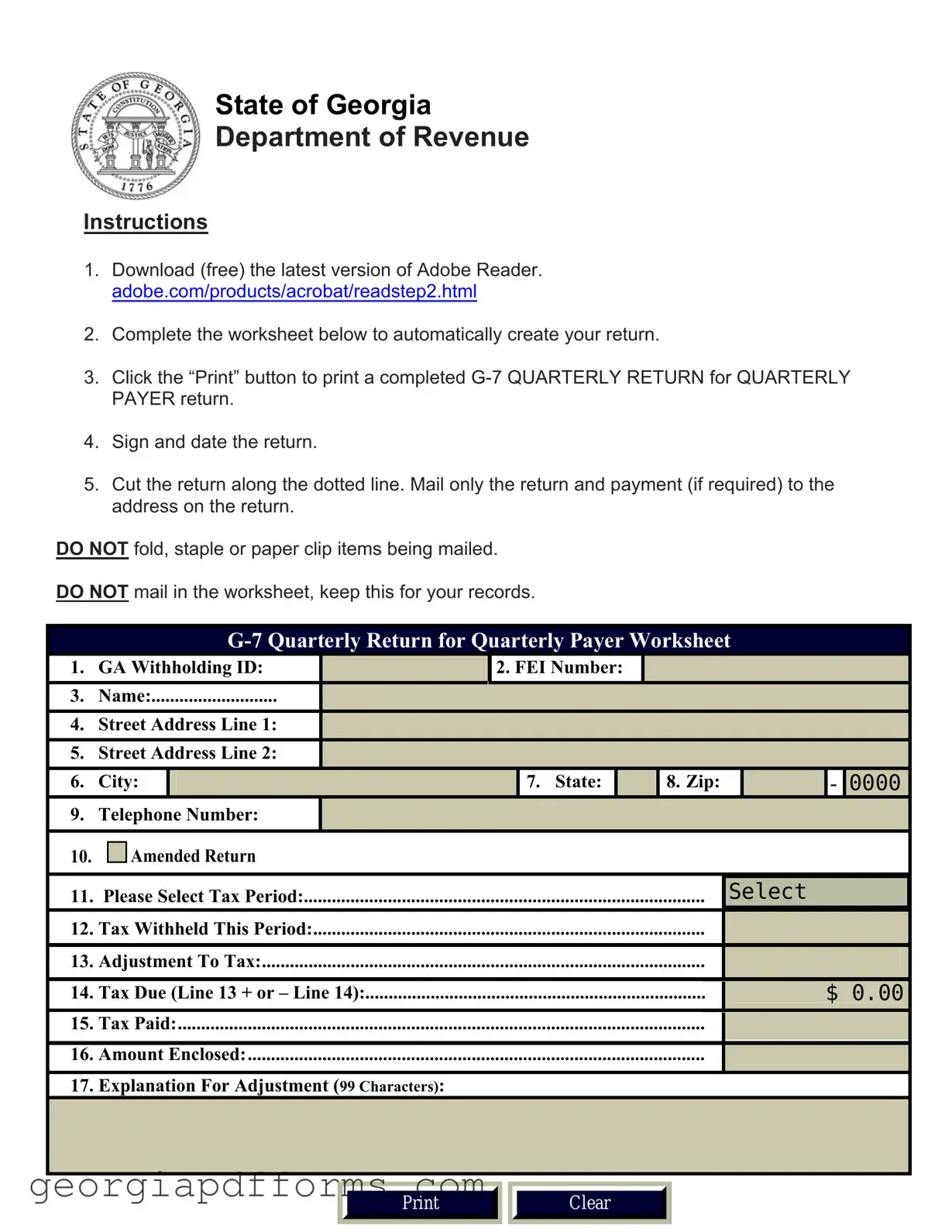

Fill a Valid Georgia G 7 Template

The Georgia G 7 form is a tax document used by employers to report and remit state income tax withheld from employees' wages on a quarterly basis. This form is essential for ensuring compliance with Georgia's tax laws, as it must be filed even if no tax was withheld during a particular quarter. Timely submission is critical; penalties apply for late filings, underscoring the importance of understanding the form's requirements and deadlines.

Access Editor Now

Fill a Valid Georgia G 7 Template

Access Editor Now

Almost there — finish the form

Fill and complete Georgia G 7 online fast.

Access Editor Now

or

Free PDF File