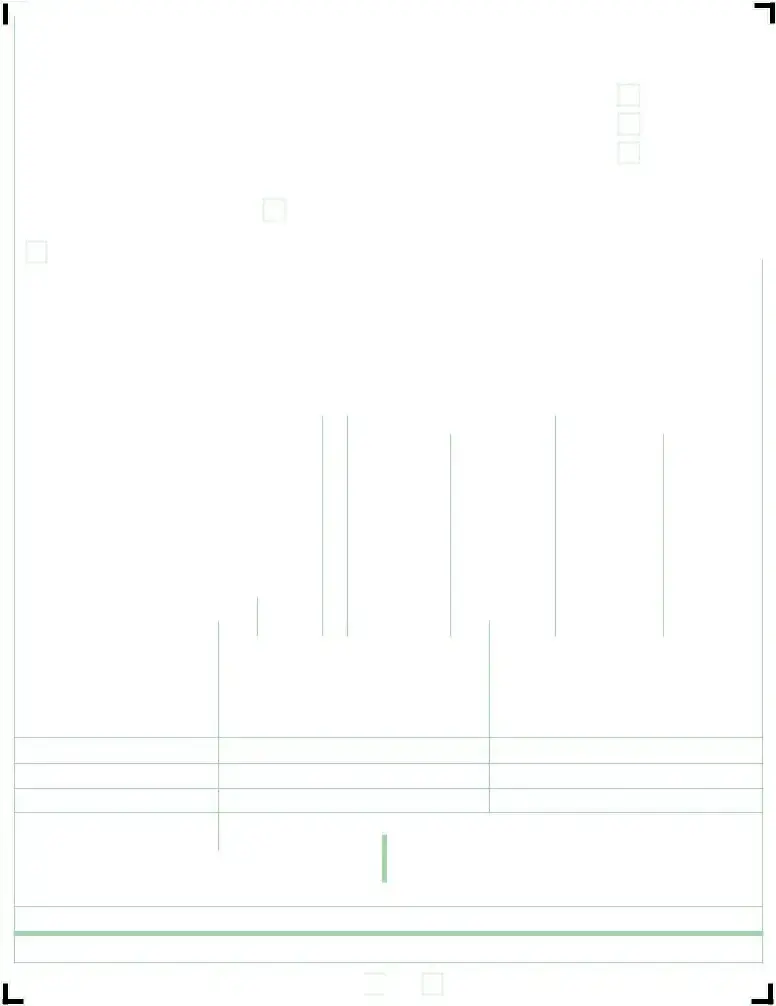

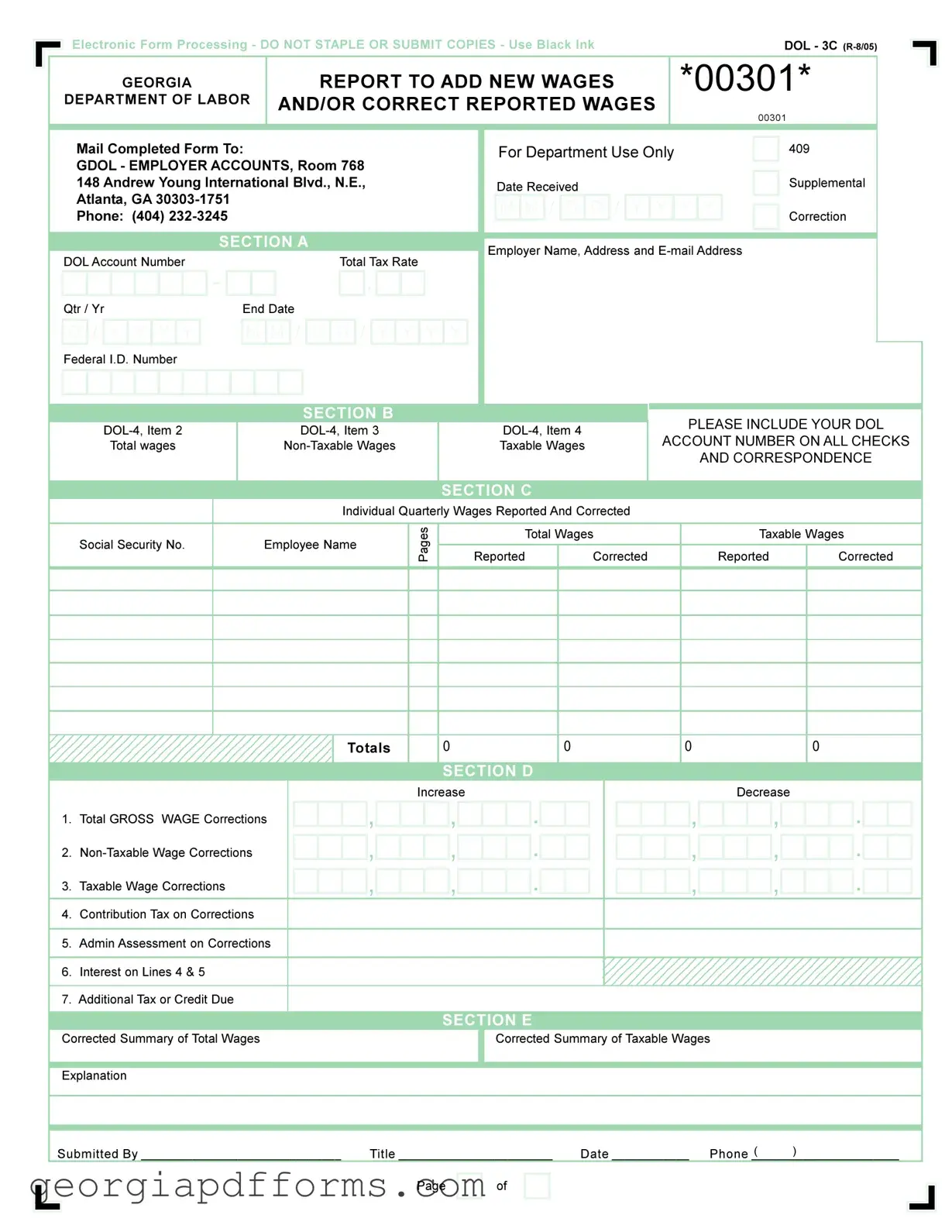

Electronic Form Processing - DO NOT STAPLE OR SUBMIT COPIES - Use Black InkDOL - 3C (R-8/05)

Electronic Form Processing - DO NOT STAPLE OR SUBMIT COPIES - Use Black InkDOL - 3C (R-8/05)

|

|

|

|

|

GEORGIA |

|

|

|

|

|

|

|

|

REPORT TO ADD NEW WAGES |

|

|

*00301* |

|

|

|

|

DEPARTMENT OF LABOR |

|

|

AND/OR CORRECT REPORTED WAGES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail Completed Form To: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ForDepartmentUseOnly |

|

|

|

409 |

|

|

|

|

GDOL- EMPLOYERACCOUNTS, Room 768 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

148AndrewYoung International Blvd., N.E., |

|

|

|

|

|

|

|

Date Received |

|

|

|

|

|

Supplemental |

|

|

|

Atlanta, GA30303-1751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

/ |

D |

D |

/ |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

Phone: (404) 232-3245 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Correction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Name, Address and E-mailAddress |

|

|

|

|

|

DOLAccount Number |

|

|

|

|

|

|

|

|

|

Total Tax Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qtr / Yr |

|

|

End Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q / |

Y |

Y |

Y |

Y |

|

|

|

|

M |

M |

/ |

D |

D |

/ |

|

Y |

|

Y |

|

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal I.D. Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASEINCLUDEYOURDOL |

|

|

|

|

DOL-4, Item 2 |

|

|

|

|

|

|

DOL-4, Item 3 |

|

|

|

|

|

|

|

DOL-4, Item 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNTNUMBERONALLCHECKS |

|

|

|

|

|

Total wages |

|

|

|

|

|

Non-Taxable Wages |

|

|

|

|

|

|

|

Taxable Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANDCORRESPONDENCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Quarterly Wages ReportedAnd Corrected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security No. |

|

|

|

|

Employee Name |

Pages |

|

|

|

|

|

|

Total Wages |

|

|

|

|

Taxable Wages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported |

|

Corrected |

|

|

|

Reported |

Corrected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase |

|

|

|

|

|

|

|

|

|

Decrease |

|

|

|

|

1. |

Total GROSS WAGE Corrections |

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Non-Taxable Wage Corrections |

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Taxable Wage Corrections |

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

4.Contribution Tax on Corrections

5.Admin Assessment on Corrections

6.Interest on Lines 4 & 5

7.Additional Tax or Credit Due

|

|

SECTION E |

|

Corrected Summary of Total Wages |

Corrected Summary of Taxable Wages |

|

|

|

|

|

|

|

Explanation |

|

Submitted By_______________________________ |

Title________________________ |

Date____________ |

( |

) |

Phone_______________________ |

Page

of

of

INSTRUCTIONS FOR COMPLETING FORM DOL-3C

“REPORT TO ADD NEW WAGES AND/OR CORRECT REPORTED WAGES”

The form is designed to: (1) correct previously reported wages and/or (2) report individuals that were omitted from the original Employer’s Quarterly Tax and Wage Report, Form DOL-4. Complete one or more of these forms separately for

each quarterly report that is to be corrected.

SECTION A

Enter the DOL Account Number. Enter the Total Tax Rate, (Contribution plus Administrative Assessment). Enter the quarter and 4 digit year. Enter the quarter ending date. Enter the Federal I.D. Number. Enter Employer Name, Address and E-mail.

SECTION B

Enter the amounts as originally reported on lines 2, 3 & 4 of the Employer’s Quarterly Tax and Wage Report, Form DOL-4 being corrected. Taxable wages in Georgia for 2012 and prior years is the first $8,500 paid per employee per year. Taxable wages beginning 2013 is $9,500.

SECTION C

Enter the Social Security Numbers and Names of the employees omitted or incorrectly reported on the original report. Enter the page number on which the employees were originally reported. In the spaces provided, enter the amount of total wages reported for the employee; the corrected amount of total wages; the taxable wages reported (amount included in Line 4 of the Quarterly Tax and Wage Report), and the corrected amount of taxable wages.

Total and taxable wages as reported and as corrected should be totaled, as the last item in Section C. Page totals should be entered on each page if more than one form is submitted for a quarter. The final total should be entered on the last page.

SECTION D

Line 1: Enter the difference between the Total Wages Reported and the Total Corrected Wages from Section C as either an increase or decrease, if applicable.

Line 2: Enter the difference in the Corrected Non-Taxable Wages and the previous reported Non-Taxable Wages from Section B either an increase or decrease.

Line 3: Enter the difference between the Total Taxable Wages Reported and the Total Corrected Taxable Wages amount from Section C as either an increase or decrease.

Line 4: Multiply the Taxable Wages, Line 3 by the contributory tax rate for that quarter.

Line 5: Multiply the Taxable Wages, Line 3 by the administrative assessment tax rate for that quarter.

Line 6: Interest is computed on the tax due (Line 4 + Line 5) from the due date until paid at the rate of one and one-half percent (1-1/2%) per month or fraction of a month. Interest is not applicable on a tax decrease.

Line 7: Enter total of Line 4 through 6. If the total reflects an increase in tax due, make check payable to Georgia Department of Labor. Please include your Georgia DOL Account Number on your check. A decrease may result in a credit to your account.

SECTION E

To adjust total wages, the amount of increase should be added to the amount entered in Item 2 in Section B or the amount of decrease should be subtracted from Item 2 in Section B. The result of the addition or subtraction should be entered as Corrected Summary of Total Wages.

To adjust taxable wages, the amount of increase should be added to the amount entered in Item 4 in Section B or the amount of decrease should be subtracted from Item 4 in Section B. The result of the addition or subtraction should be entered as Corrected Summary of Taxable Wages.

Enter your explanation of the adjustment in the space provided.

Enter your name on the “Submitted By” line, Title, Date, and Telephone Number and return as indicated on the front of the form.

DOL-3C Instr (R-12/12)

Electronic Form Processing - DO NOT STAPLE OR SUBMIT COPIES - Use Black Ink

Electronic Form Processing - DO NOT STAPLE OR SUBMIT COPIES - Use Black Ink

of

of