Fill a Valid Georgia Att 112 Template

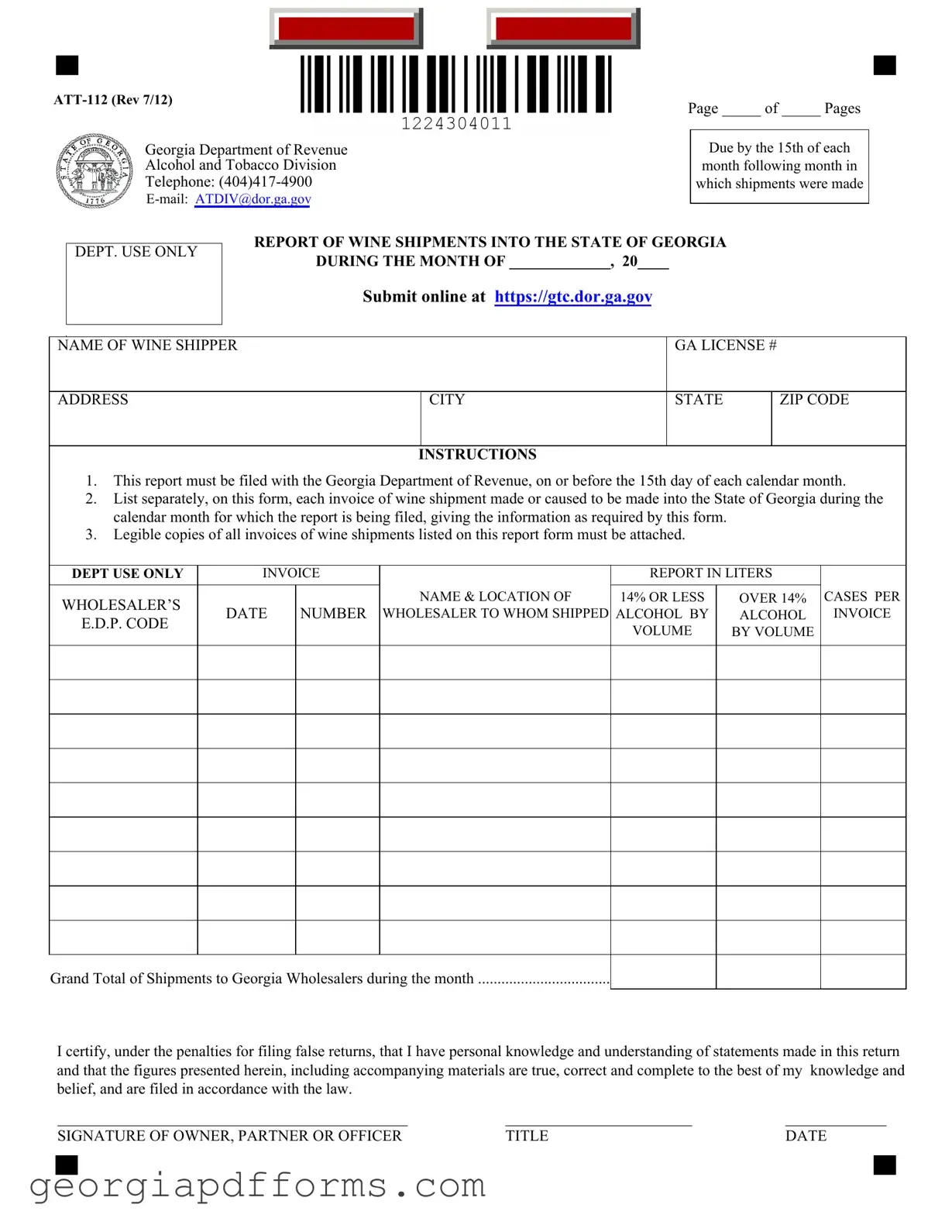

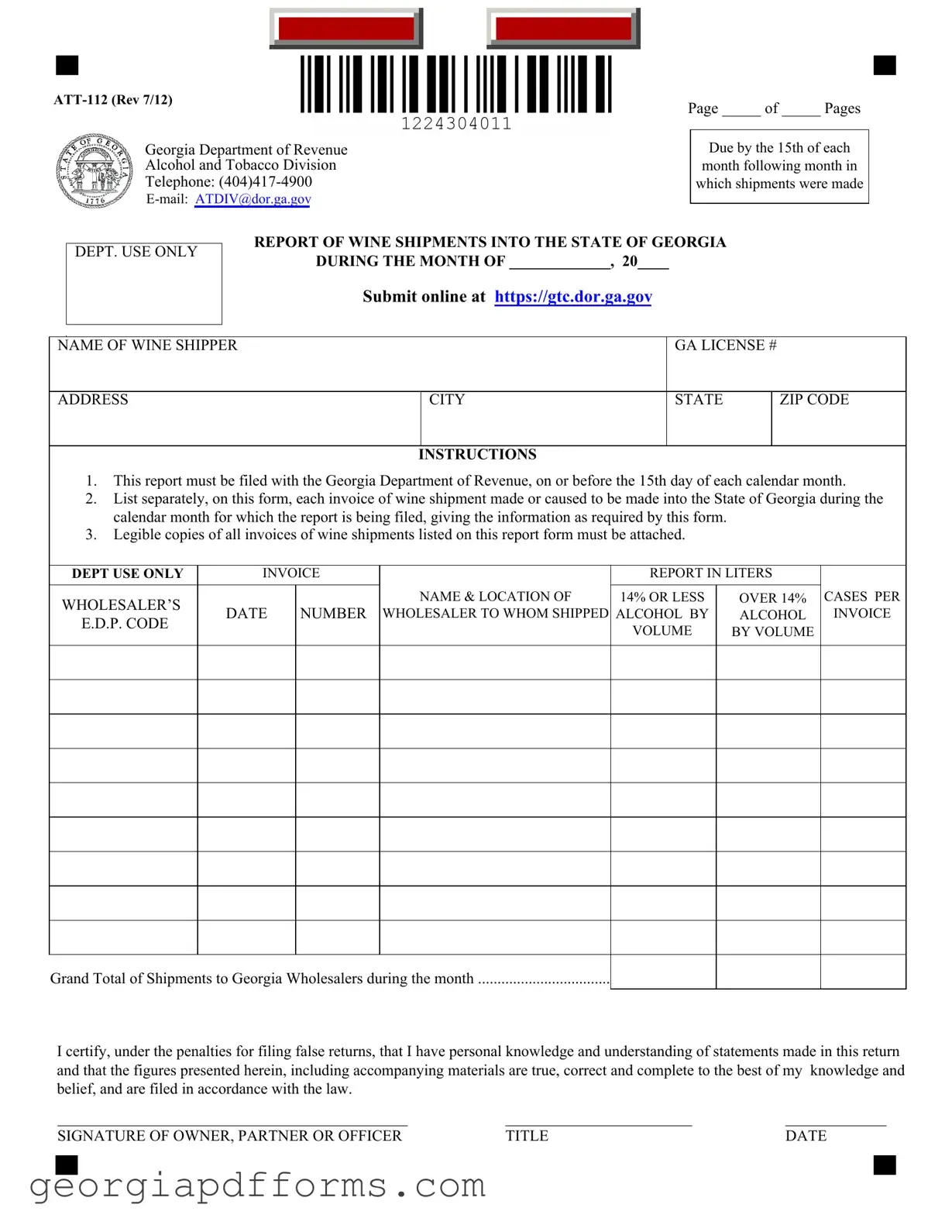

The Georgia ATT 112 form is a report required by the Georgia Department of Revenue for documenting wine shipments into the state. This form must be submitted by the 15th of each month, detailing all wine shipments made during the previous month. Accurate completion and timely submission are essential to comply with state regulations.

Access Editor Now

Fill a Valid Georgia Att 112 Template

Access Editor Now

Almost there — finish the form

Fill and complete Georgia Att 112 online fast.

Access Editor Now

or

Free PDF File