What is the Georgia 525-TV form?

The Georgia 525-TV form is a payment voucher used by individuals and fiduciaries to submit payments for taxes owed to the Georgia Department of Revenue. It is essential for ensuring that payments are correctly processed and credited to the taxpayer's account.

Who needs to use the 525-TV form?

This form should be used by individuals or fiduciaries who owe taxes to the state of Georgia. If you are filing a return and have a balance due, you will need to complete this voucher to accompany your payment.

How do I complete the 525-TV form?

To complete the 525-TV form, first download the latest version of Adobe Reader. Then, fill out the worksheet provided, which will help generate the payment voucher. After filling it out, print the completed voucher and cut it along the dotted line. Remember to keep the worksheet for your records.

Where do I send my payment and the 525-TV form?

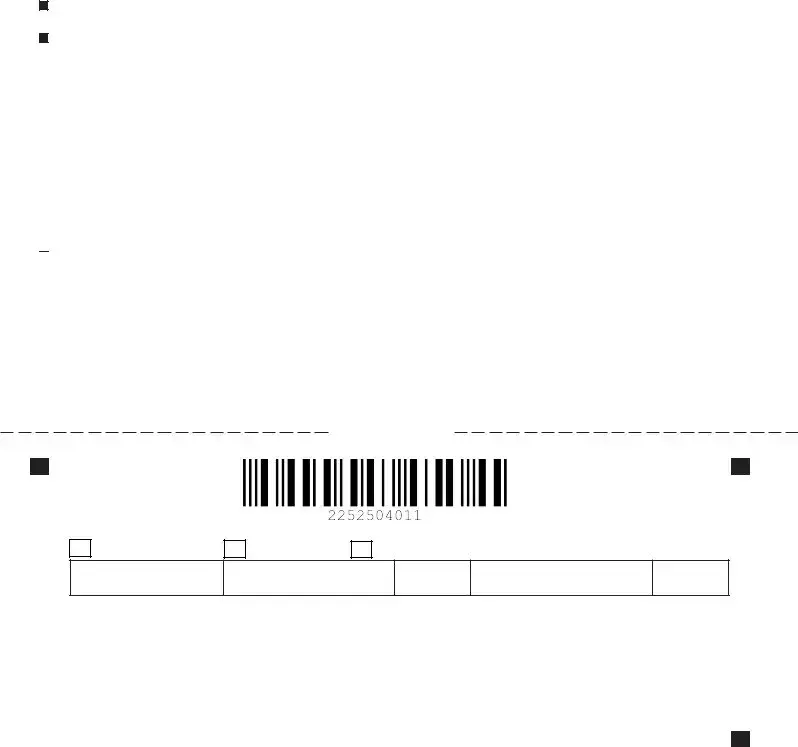

If you are filing electronically, mail your payment and the voucher to the Processing Center at the Georgia Department of Revenue, PO Box 740323, Atlanta, Georgia 30374-0323. If you are filing a paper return, send the return along with the 525-TV voucher and payment to the address indicated on your return.

What should I include with my payment?

When mailing your payment, make sure to include the completed 525-TV voucher. It is important to write your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) on your check or money order. Do not send the entire worksheet; only the voucher and payment are required.

Can I file my taxes electronically and still use the 525-TV form?

Yes, you can file your taxes electronically. If you do so, you will still need to print and mail the 525-TV voucher along with your payment. Ensure that you do not send the entire tax return, just the voucher and payment.

What if the due date falls on a weekend or holiday?

If the due date for your tax payment falls on a weekend or holiday, your payment will be due on the next business day. It is crucial to keep this in mind to avoid any late fees or penalties.

Is there a specific way I should mail my payment?

Yes, when mailing your payment, do not fold, staple, or paper clip the items. This helps ensure that your payment is processed without any issues. Remove any attached check stubs and only send the voucher and payment.

What happens if I don’t include the 525-TV form with my payment?

If you do not include the 525-TV form with your payment, it may lead to delays in processing your payment. The voucher helps the Georgia Department of Revenue match your payment to your account, so it is important to include it.

Can I get assistance if I have questions about the 525-TV form?

If you have questions about the 525-TV form or the payment process, you can reach out to the Georgia Department of Revenue directly or consult their website for additional resources and guidance.

For faster and more accurate posting to your account, use a payment voucher with a

For faster and more accurate posting to your account, use a payment voucher with a

Only complete this voucher if you owe taxes.

Only complete this voucher if you owe taxes.

Complete the name and address field located on the upper right side of the voucher.

Complete the name and address field located on the upper right side of the voucher.

If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday.

If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday.

If you are

If you are

If you are filing a paper return; mail your return,

If you are filing a paper return; mail your return,