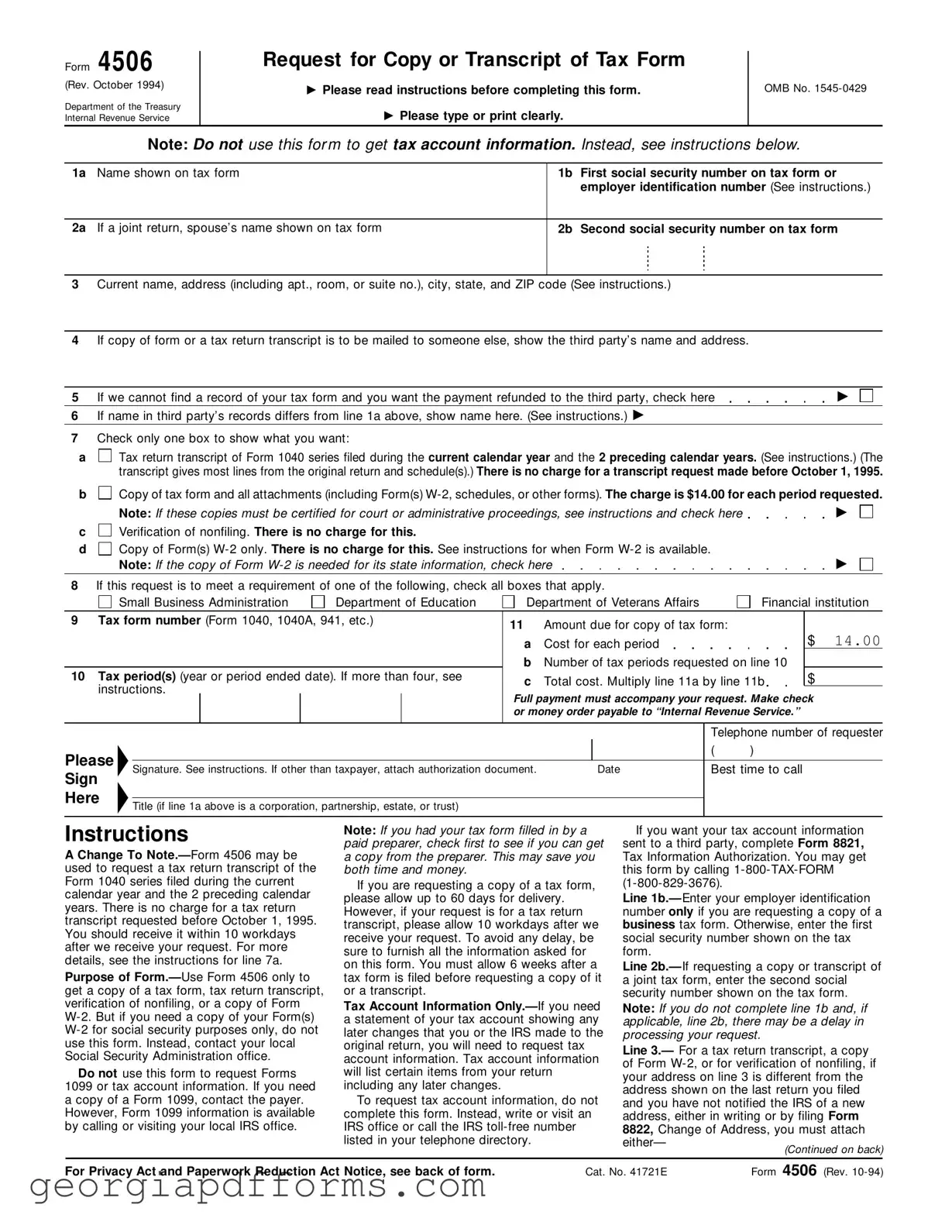

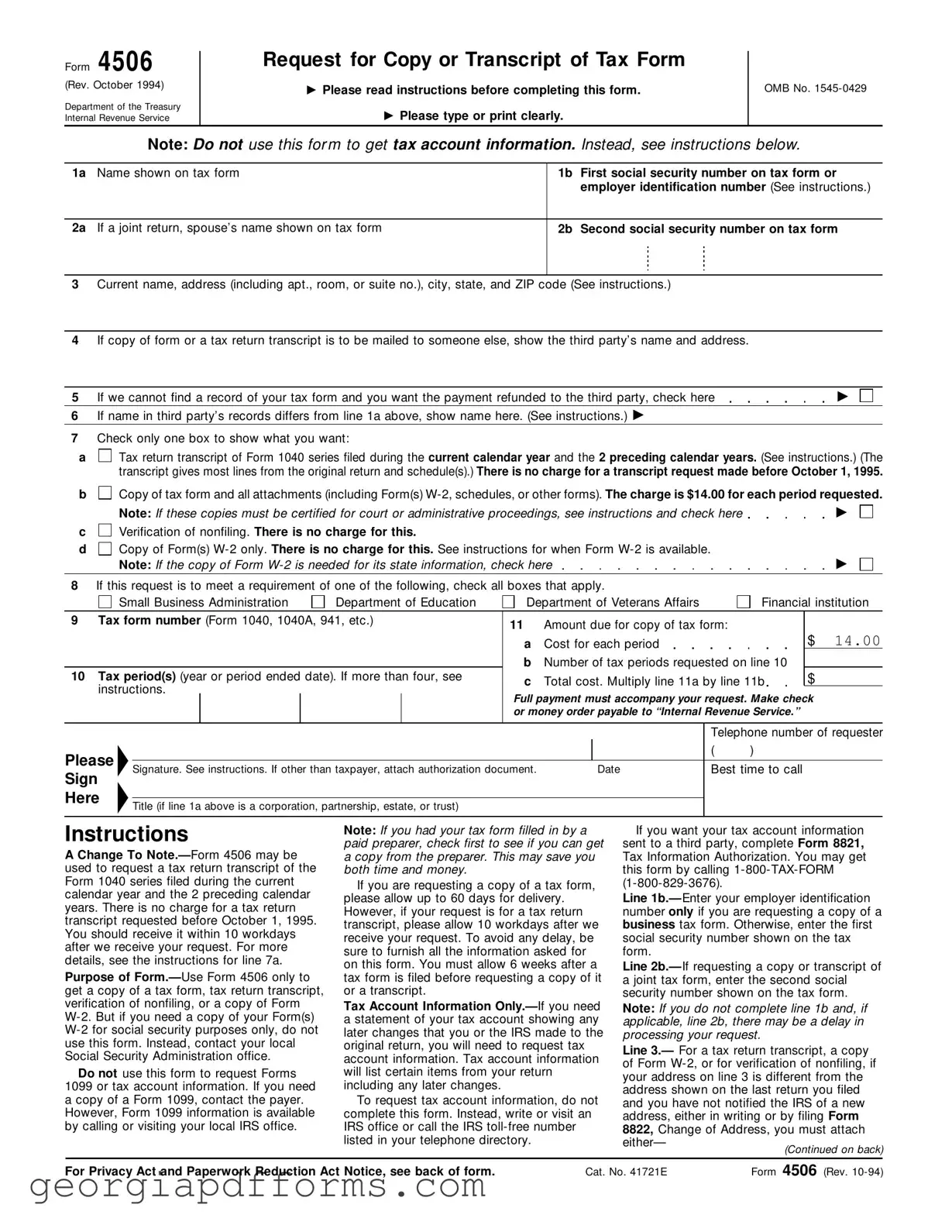

What is the Georgia 4506 form?

The Georgia 4506 form is a request form used to obtain copies or transcripts of tax forms filed with the Internal Revenue Service (IRS). It allows individuals to request their tax return transcripts, copies of specific tax forms, verification of nonfiling, or copies of Form W-2. This form is particularly useful for those needing tax documents for various purposes, such as applying for loans or financial aid.

Who should use the Georgia 4506 form?

This form is intended for individuals who need to access their tax information from the IRS. It is suitable for taxpayers who have filed a Form 1040 series tax return in the current calendar year or the two preceding years. Additionally, it can be used by authorized representatives or third parties, provided they have the necessary authorization from the taxpayer.

How do I fill out the Georgia 4506 form?

To complete the form, you must provide your name, Social Security number, and address as shown on your tax return. If applicable, include your spouse's information if filing jointly. Specify what type of document you are requesting, whether it’s a tax return transcript, a copy of a tax form, or Form W-2. Ensure that all required fields are filled out clearly and accurately to avoid processing delays.

What types of documents can I request using this form?

You can request several types of documents using the Georgia 4506 form, including a tax return transcript for the Form 1040 series, copies of tax forms and attachments, verification of nonfiling, and copies of Form W-2. Each document type may have different processing times and fees, so be sure to check the specific requirements for each request.

Is there a fee associated with the Georgia 4506 form?

Yes, there may be a fee for certain requests. For instance, requesting a copy of a tax form and all attachments incurs a charge of $14. However, obtaining a tax return transcript or verification of nonfiling is free of charge. It is essential to include payment with your request if applicable, and ensure that the payment is made out to the IRS.

How long does it take to receive the requested documents?

Once the IRS receives your completed request, processing times can vary. Typically, you should expect to receive a tax return transcript within 10 workdays. For copies of tax forms, the processing time may take up to 60 days. To ensure timely processing, make sure all information is accurate and complete.

Where should I send the completed Georgia 4506 form?

The completed form should be mailed to the appropriate IRS address based on your state of residence at the time the tax form was filed. Each state has a designated IRS center, and it’s important to send your request to the correct location to avoid delays in processing.

What if I need to authorize someone else to receive my tax documents?

If you want a third party, such as a tax professional or lender, to receive your tax documents, you must provide their name and address on the form. Additionally, you must sign the form, indicating that you authorize them to access your tax information. If you are not the taxpayer, you will need to attach the appropriate authorization document to your request.

What should I do if my address has changed since filing my last tax return?

If your address has changed, you must provide your current address on the form. If it differs from the address on your last filed return, you will need to attach either two forms of identification or a notarized statement affirming your identity. This helps the IRS verify your request and ensures that your documents are sent to the correct address.