What is a Durable Power of Attorney in Georgia?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial affairs and make decisions on your behalf if you become incapacitated. Unlike a standard power of attorney, the durable version remains effective even if you are unable to make decisions for yourself due to illness or injury.

Who can be appointed as an agent in a Durable Power of Attorney?

You can choose any competent adult as your agent, also known as an attorney-in-fact. This can be a family member, friend, or a trusted advisor. It is crucial to select someone you trust completely, as they will have significant control over your financial matters.

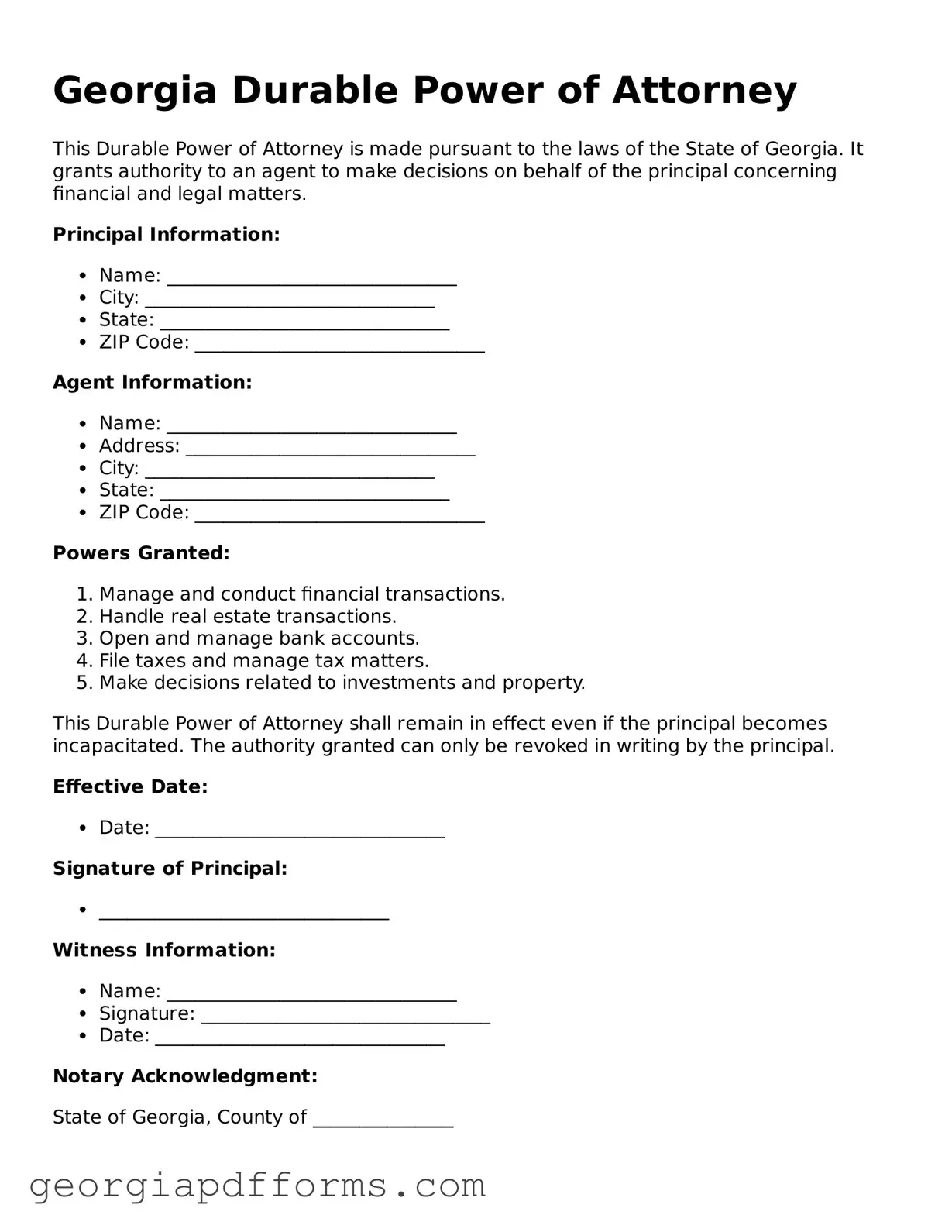

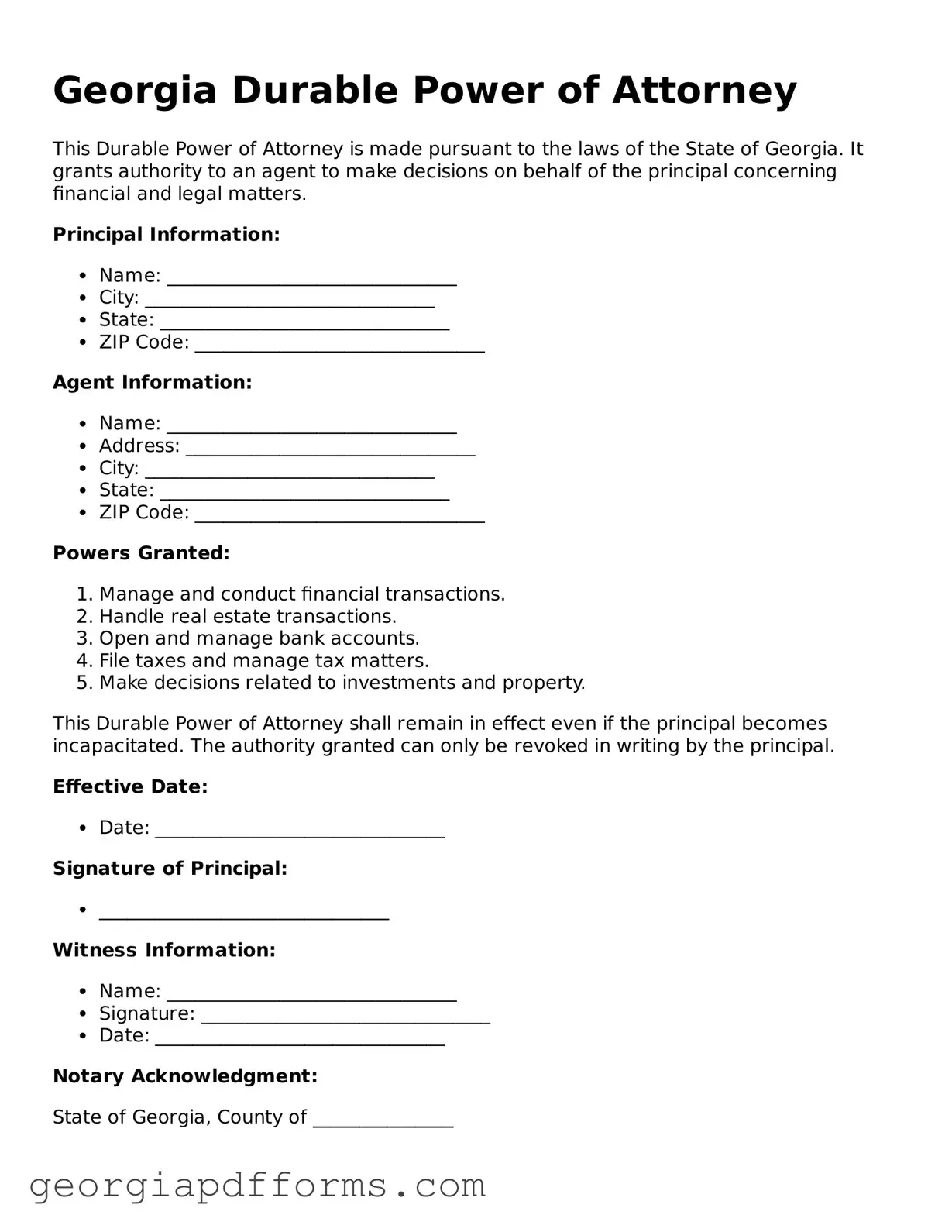

Does a Durable Power of Attorney need to be notarized in Georgia?

Yes, in Georgia, a Durable Power of Attorney must be signed in the presence of a notary public to be legally binding. Additionally, it is advisable to have witnesses sign the document, although this is not a strict requirement. Notarization adds an extra layer of validity and helps prevent disputes in the future.

Can I revoke my Durable Power of Attorney once it is created?

Absolutely. You have the right to revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you must create a written document stating your intention to revoke it and notify your agent and any relevant financial institutions.

What powers can I grant to my agent in a Durable Power of Attorney?

You can grant a wide range of powers, including managing bank accounts, handling real estate transactions, paying bills, and making investment decisions. It is essential to be specific about the powers you wish to grant to ensure your agent acts in your best interests.

What happens if I do not have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney in place, your loved ones may have to go through a lengthy and costly court process to obtain guardianship or conservatorship. This process can be emotionally taxing and may not reflect your wishes, making it crucial to have a durable power of attorney established while you are still able to make decisions.

Is there a specific form I need to use for a Durable Power of Attorney in Georgia?

While Georgia does not require a specific form, it is highly recommended to use a standard template that complies with state laws. These templates are widely available online and can help ensure that all necessary elements are included, minimizing the risk of errors or omissions.

How can I ensure my Durable Power of Attorney is effective?

To ensure your Durable Power of Attorney is effective, make sure it is properly signed, dated, and notarized. Discuss your wishes with your chosen agent so they understand your preferences. Finally, provide copies to your agent, financial institutions, and healthcare providers, as needed, to avoid any confusion when the document is needed.