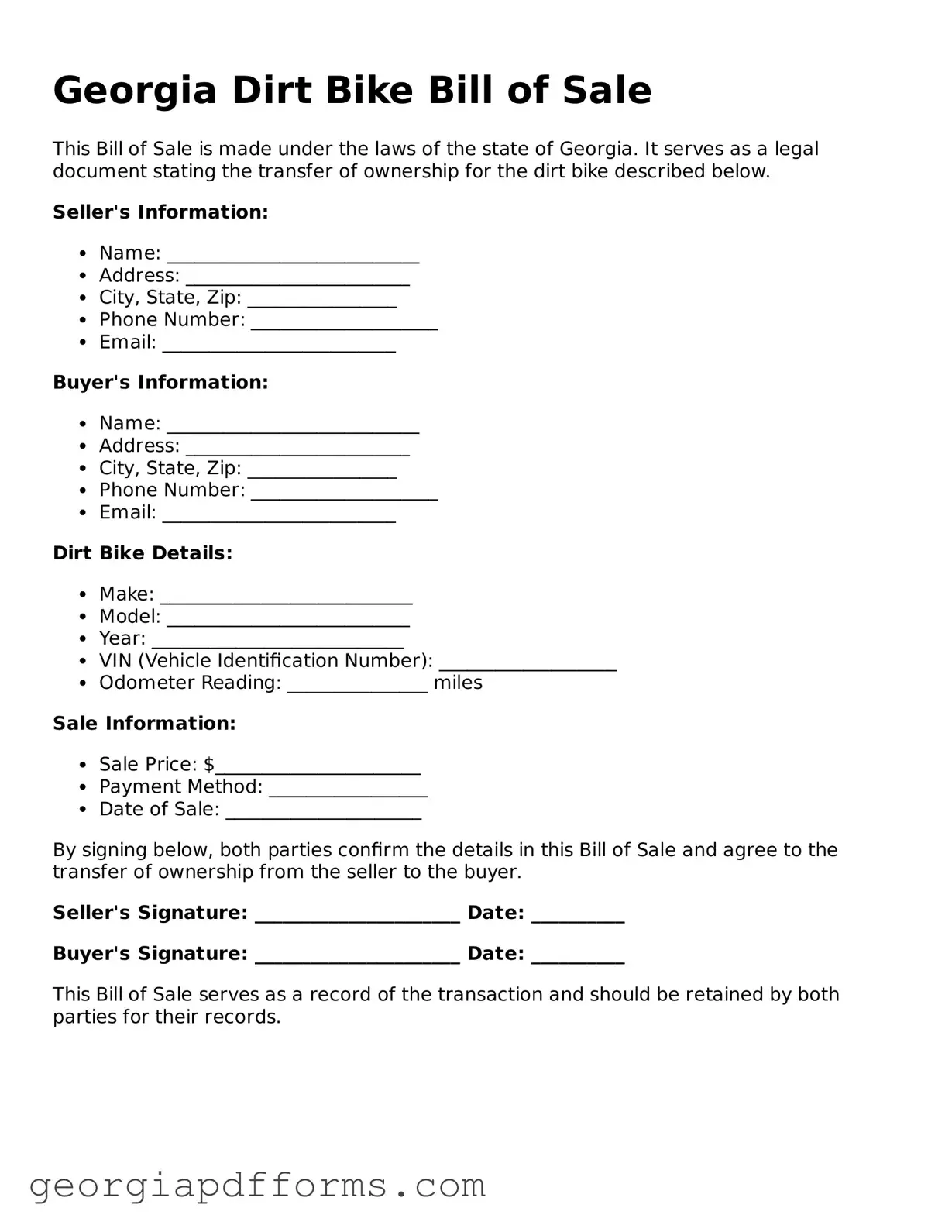

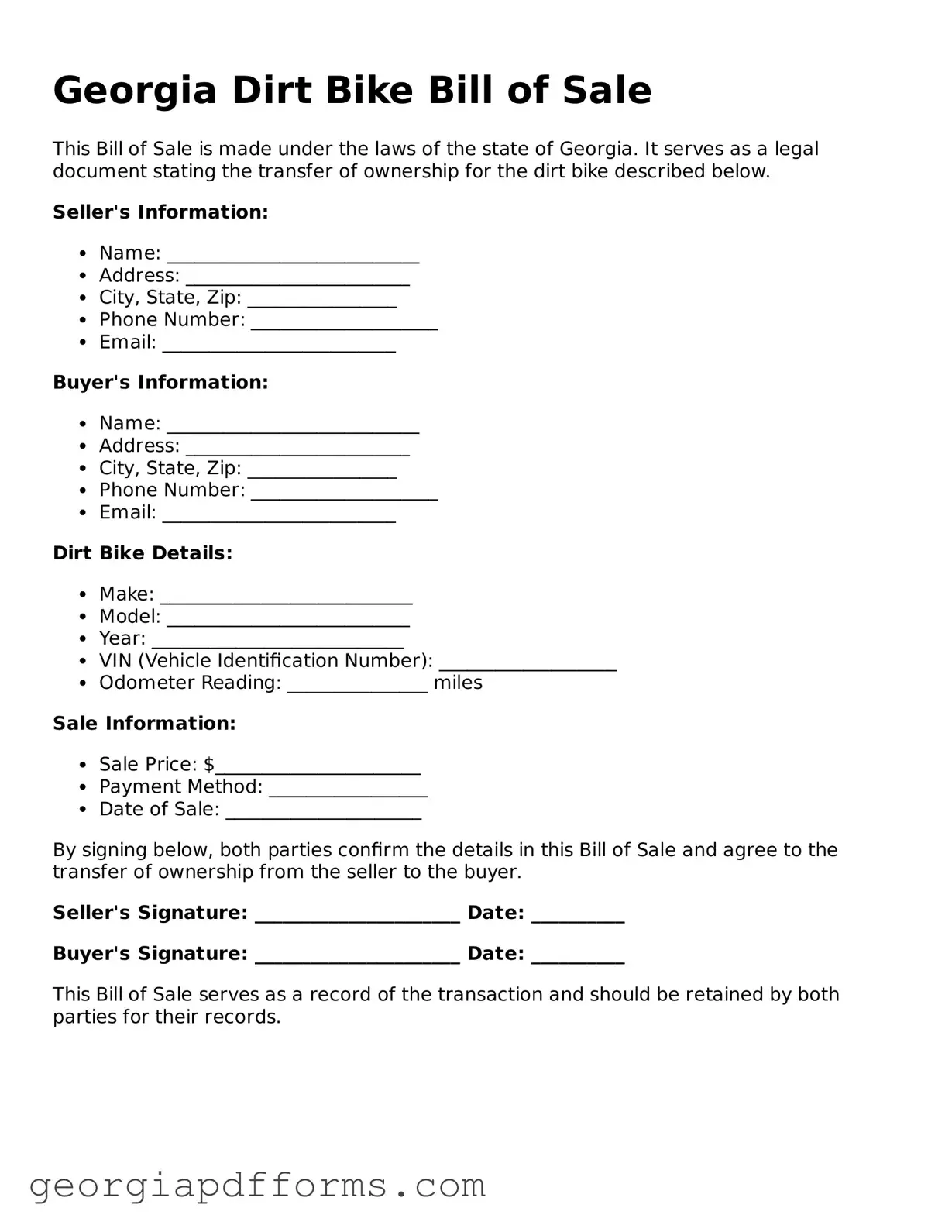

What is a Georgia Dirt Bike Bill of Sale form?

A Georgia Dirt Bike Bill of Sale form is a legal document that records the transfer of ownership of a dirt bike from one person to another. It serves as proof of the transaction and includes important details about the bike and the parties involved in the sale.

Why do I need a Bill of Sale for a dirt bike in Georgia?

Having a Bill of Sale is crucial for several reasons. It protects both the buyer and the seller by providing a record of the transaction. In Georgia, it can also be required for registering the dirt bike with the Department of Natural Resources, ensuring that the new owner can legally operate the vehicle.

What information should be included in the Bill of Sale?

The Bill of Sale should include the following details: the names and addresses of both the buyer and the seller, the make, model, year, and Vehicle Identification Number (VIN) of the dirt bike, the sale price, and the date of the transaction. It’s also advisable to include any additional terms or conditions agreed upon by both parties.

Do I need to have the Bill of Sale notarized?

In Georgia, notarization is not a requirement for a Bill of Sale. However, having the document notarized can add an extra layer of security and authenticity, which may be beneficial if any disputes arise in the future.

Can I create my own Bill of Sale for a dirt bike?

Yes, you can create your own Bill of Sale. There are templates available online that you can use as a guide. Just ensure that all necessary information is included and that both parties sign the document. Alternatively, using a standard form can simplify the process.

Is a Bill of Sale required for all dirt bike sales in Georgia?

While a Bill of Sale is not legally required for every dirt bike sale, it is highly recommended. It helps establish proof of ownership and can be necessary for registration purposes. If the dirt bike is being sold by a dealer, they may provide their own documentation.

What if the dirt bike has a lien on it?

If there is a lien on the dirt bike, it’s essential to resolve this before completing the sale. The seller should pay off the lien and obtain a lien release. This protects the buyer from potential legal issues and ensures that they receive clear title to the bike.

How does a Bill of Sale affect taxes?

When purchasing a dirt bike, the Bill of Sale can impact sales tax obligations. Buyers are typically responsible for paying sales tax based on the purchase price when registering the bike. Keeping a copy of the Bill of Sale is important for this purpose.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep copies for their records. The buyer should also take the document to the local Department of Natural Resources to register the dirt bike and obtain a new title, if necessary.

Where can I find a Georgia Dirt Bike Bill of Sale template?

Templates for a Georgia Dirt Bike Bill of Sale can be found online on various legal websites, or you can visit your local DMV or Department of Natural Resources office for a form. Many sites offer free downloadable templates that are easy to fill out.