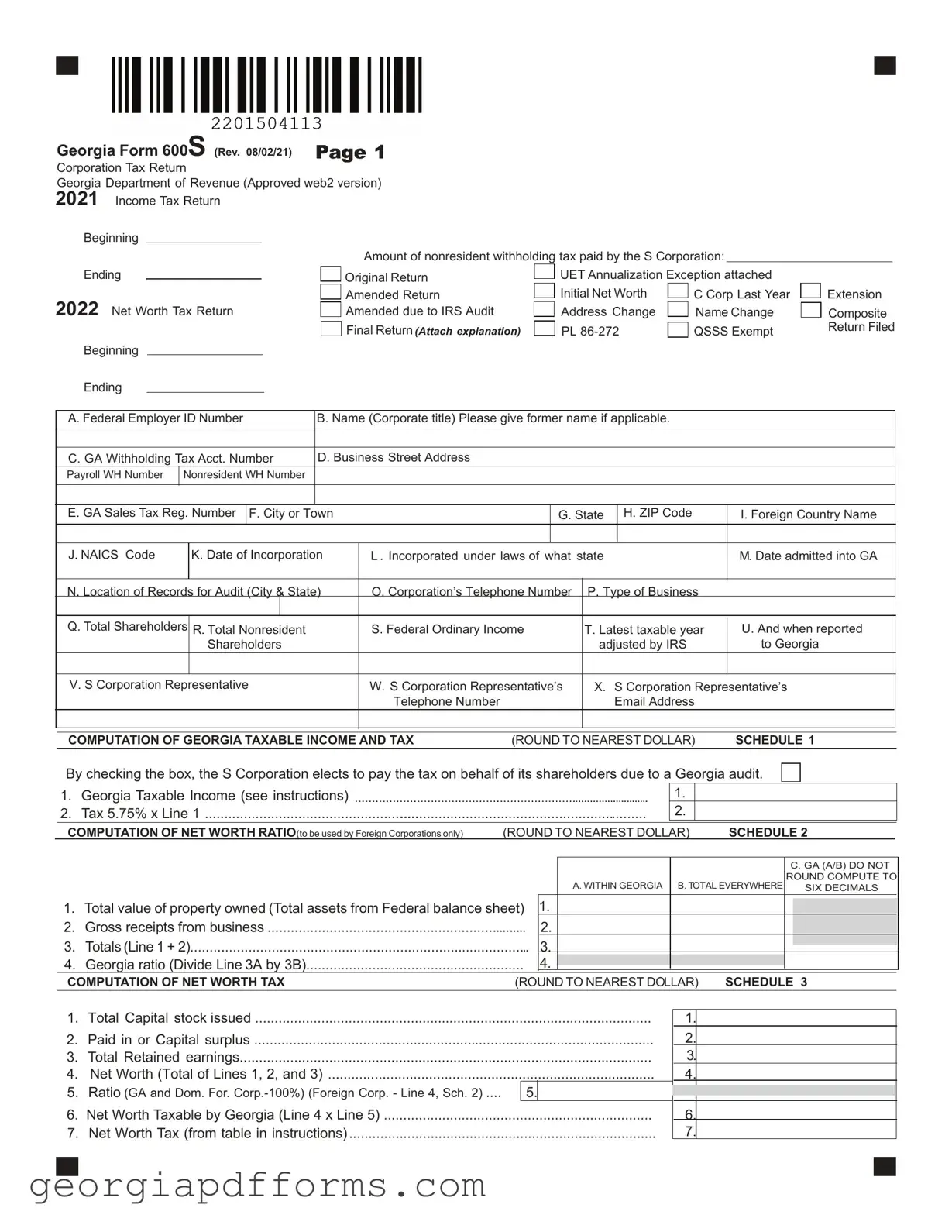

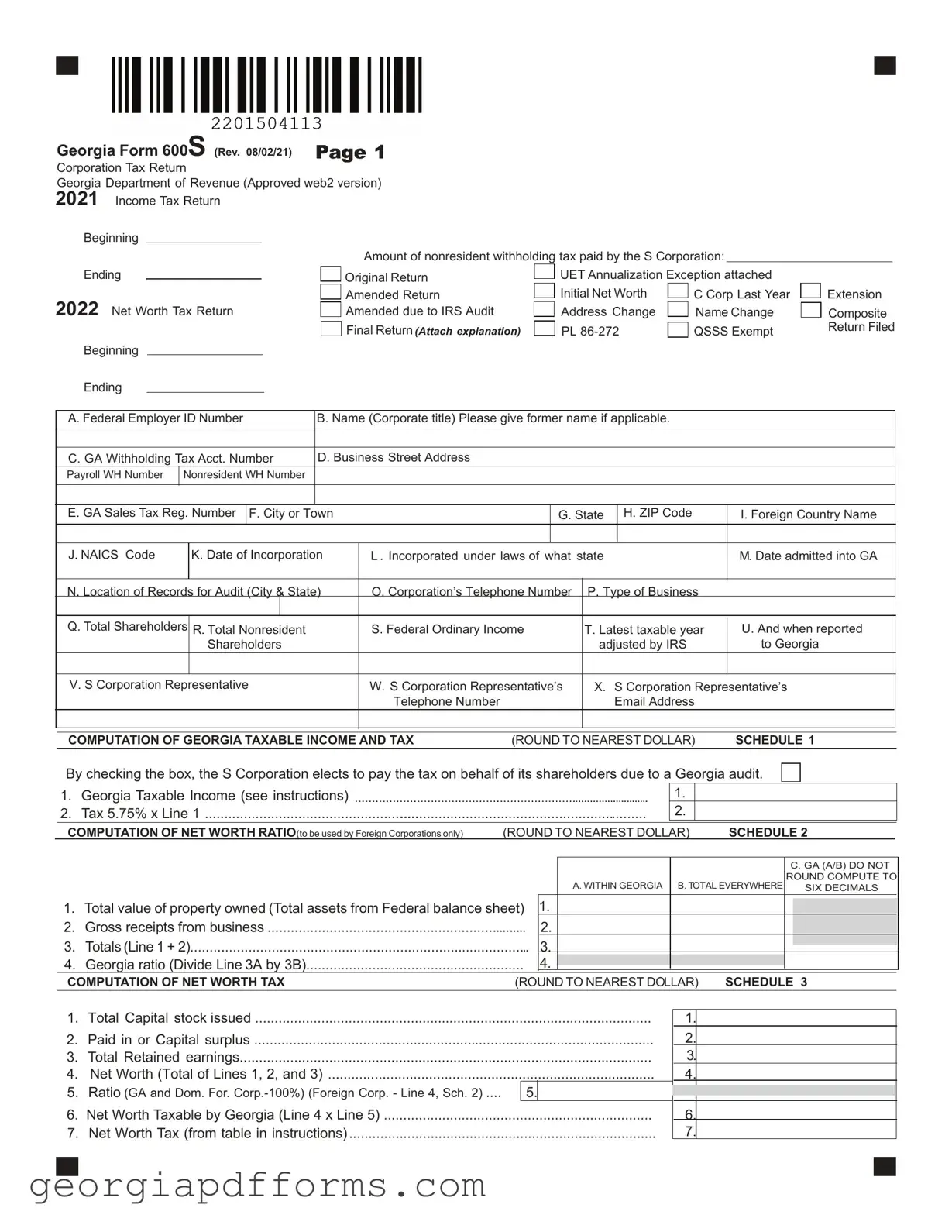

What is the purpose of the Georgia Form 600S?

The Georgia Form 600S is used by S Corporations to report income, deductions, and tax liability to the Georgia Department of Revenue. This form is essential for ensuring compliance with state tax laws and for calculating the appropriate tax owed by the corporation.

Who needs to file the Georgia Form 600S?

Any S Corporation that conducts business in Georgia or has shareholders who are residents of Georgia must file this form. This includes corporations that have elected S Corporation status for federal tax purposes and meet the state's requirements.

What information is required to complete the form?

The form requires basic information such as the corporation's name, address, federal employer ID number, and Georgia withholding tax account number. Additionally, it asks for details about income, shareholders, and any tax credits being claimed.

How is the Georgia taxable income calculated?

Georgia taxable income is calculated by starting with the total income for federal purposes and making necessary adjustments for state-specific additions and subtractions. This includes accounting for income allocated to Georgia and any business income subject to apportionment.

What is the tax rate applied to Georgia taxable income?

The tax rate for Georgia taxable income is 5.75%. This rate is applied to the amount reported on Line 1 of Schedule 1 of the form.

What is the net worth tax and who is subject to it?

The net worth tax applies to foreign corporations doing business in Georgia. The tax is based on the corporation's total capital stock, surplus, and retained earnings, and it is calculated using a specific formula outlined in the form.

What are the filing deadlines for the Georgia Form 600S?

The Georgia Form 600S is due on the 15th day of the third month following the end of the corporation's tax year. If the corporation has a federal extension, it may also extend the Georgia filing deadline by submitting a copy of the federal extension request.

Can I claim tax credits on the Georgia Form 600S?

Yes, tax credits can be claimed on the form. However, to claim these credits, they must be filed electronically. The form includes a section for detailing any credits used and their allocation to the shareholders.

What happens if the form is filed late?

If the Georgia Form 600S is filed late, the corporation may incur penalties and interest on any unpaid taxes. It is essential to file on time to avoid these additional costs.

Where should the completed form be mailed?

The completed Georgia Form 600S should be mailed to the Georgia Department of Revenue, Processing Center, PO Box 740391, Atlanta, Georgia 30374-0391. Ensure that the form is sent to the correct address to avoid processing delays.

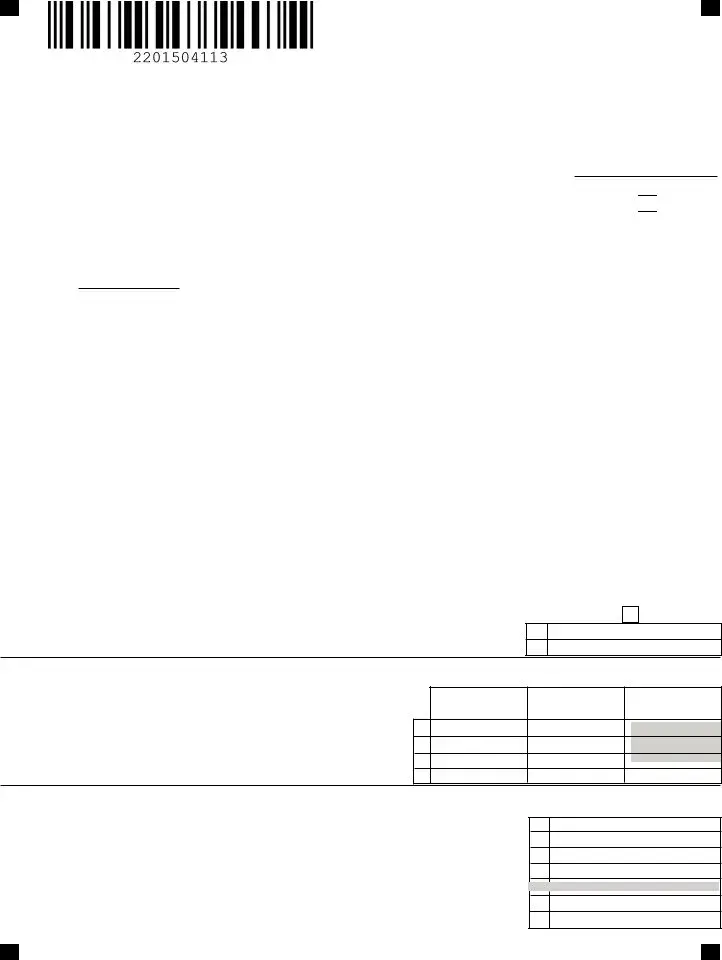

Extension

Extension

Composite

Composite

8. 9.

8. 9.  10.

10.